UK retailers spent £1.2 billion processing card payments in 2021

Carmen James - 19th Dec, 2022

Insights from the BRC's Payments Survey 2022: with cash use plummeting, businesses must address the rising cost of card payments.

What does the UK retail sector want for Christmas this year?

As sales volumes continue to lag behind inflation due to the cost of living crisis, an end to the £1.2 billion spent on card processing fees would certainly be a nice stocking filler.

British Retail Consortium: Payments Survey 2022

Recently the British Retail Consortium (BRC) published its annual Payments Survey, which, in the BRC's words, "provides the only representative and reliable measure for the cost of payment collection, as it draws on exclusive data straight from the point of sale."

2021 was an unprecedented year. Lockdowns lead to shop closures for prolonged periods, and when shops were open the Government advice was to use contactless card payments wherever possible. Ultimately, there was a change in consumer behaviour towards online shopping and it remains to be seen how much this behaviour will stick.

A number of significant payment trends were identified in this year's report, namely a dramatic shift in the balance between card and cash use. Debit card transactions have soared, now accounting for almost 70% of retail turnover, whereas cash now accounts for just 15%. At the same time, retailers are being punished by a gradual increase in the fees associated with accepting payments by debit card.

"Due to the nature of their businesses, retailers must continue accepting card payments, given 90% of transactions were made by card in 2021. Cards are now considered integral for UK consumers. However, what we are seeing is the card schemes abusing their dominant position, taking advantage of the retailers’ reliance upon their services, and increasing fees over and above what is fair." - BRC Payments Survey 2022

Card fees: The thorn in a retailer's side

In 2021 alone:

- Retailers shelled out a total of £1.3 billion on payment processing, £1.2 billion of which went on card payments

- The cost to accept debit cards grew to 0.273% of transaction value (up from 0.265% in 2020)

- Card scheme fees rose by 28% and total Merchant Service charges increased by 12%

According to the BRC's report, debit card processing costs have been steadily increasing since 2015. In 2021 alone, an additional £141 million was spent on processing debit cards vs. the previous year.

So, in a world where reaching for plastic has become the default choice how can this 'card tax' be addressed?

Solutions through Open Banking

Last year, the BRC called for Parliamentary intervention by the Treasury Committee to review the Payment Systems Regulator's strategy and ensure that anti-competitive practices in card payments could be tackled. Questions have been raised in Parliament and reviews have been conducted. But the BRC has expressed concerns that these reviews may not lead to effective regulation within the time frames required.

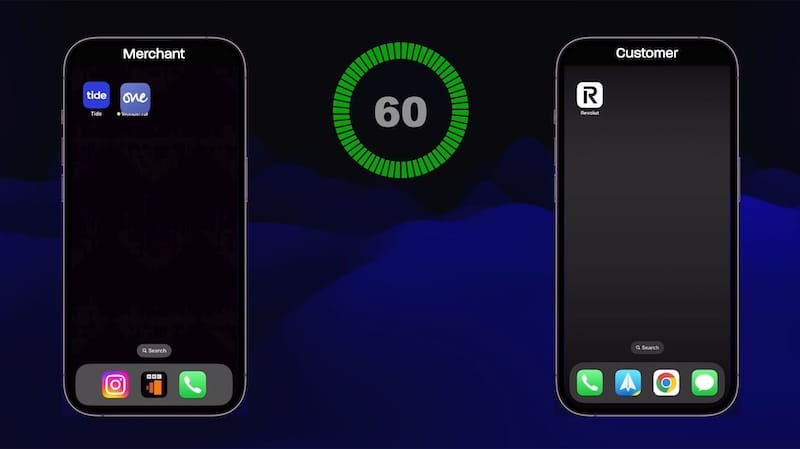

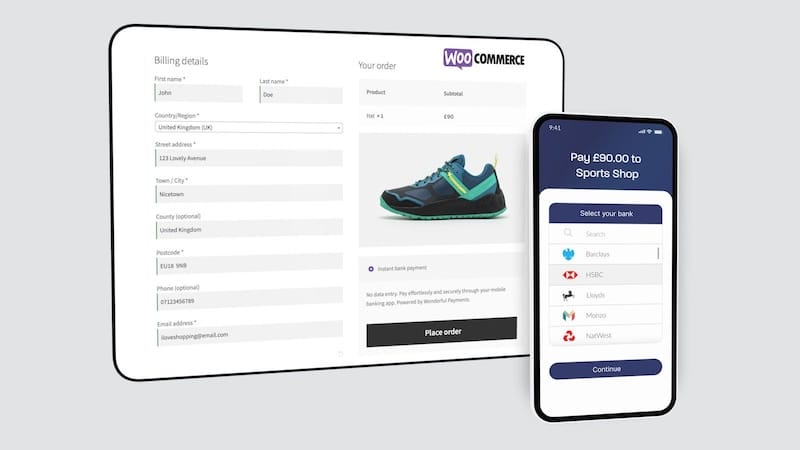

Alongside the rise in card payments comes the meteoric growth of account-to-account (A2A) payments, specifically those powered by Open Banking. Importantly, these payment initiation services are not subject to the same fees as card payments because they don't involve cards at all. Instead, the customer is connected to their existing banking app to authorise a direct and secure payment to the retailer.

"Account-to-account payments represent a key area of payments innovation and are beginning to drive much-needed competition in the market. For retailers, this competition is very welcome, bringing with it the potential for lowering transaction fees." - BRC Payments Survey 2022

Whilst Open Banking payments have seen fantastic growth since their recent introduction in 2018, many retailers are yet to take advantage of this exciting development. Open Banking payments don't just offer the opportunity to reduce payment processing costs. They also allow retailers to reduce the number of steps their customers must go through at the checkout.

In their latest report the BRC rightly points out that retailers respond directly to consumer behaviour, but consumers must also be given the opportunity to experience the benefits of alternative payment methods if they are to become champions for their adoption. This is illustrated perfectly by HMRC's recent implementation of Open Banking for online tax payments, which received very positive feedback from end-users. This successful introduction has already facilitated £1 billion in self-assessment tax payments.

Clearly, retailers cannot rely on consumer demand alone. The adoption of innovations in payments requires input at all levels. As 2023 approaches, we will no doubt see a continued evolution of the payments landscape, with savvy retailers moving to take advantage of these new account-to-account payment solutions.

Photo by Ming Han Low on Unsplash