Getting paid is killing SMEs

Kieron James - 20th Nov, 2023

For small businesses in the UK, survival often hinges on cash flow. Prompt payment of invoices is crucial. Every penny counts and the time to settle can make or break a business. Let’s shed light on timelines involved in card processing settlements, and crucially, demonstrate a better way.

The dire consequences of late payment

According to recent findings from the Federation of Small Businesses (FSB), late payments remain a significant issue for small businesses across the UK. In fact, their data revealed that around 50,000 businesses each year are forced to close their doors due to late payments, leading to a staggering £2.5 billion loss annually. These figures highlight the stark reality that delayed payments are not just an inconvenience but a direct threat to the survival of small enterprises.

Moreover, the impact of late payments extends far beyond financial strains. Small businesses are often the lifeblood of local communities, providing jobs and driving economic growth. When they face challenges due to delayed payments, it disrupts the entire ecosystem, affecting employees, suppliers, and the economy at large.

The need for prompt settlement

Timely payment is not solely a moral obligation; it’s a vital lifeline for small businesses. The Prompt Payment Code, designed to encourage and enforce prompt payment practices among larger companies, stresses the importance of settling invoices on time. Adherence to this code can significantly alleviate the financial pressure faced by small businesses, fostering an environment where they can thrive and grow.

Recent statistics from the Chartered Institute of Credit Management (CICM) demonstrate the positive impact of prompt payments. Their research reveals that businesses experiencing faster payment cycles have healthier cash flows, enabling them to invest in growth opportunities, innovation, and talent acquisition. This highlights the crucial role that prompt invoice settlements play in the long-term sustainability and success of small businesses.

Card processing settlement times: a closer look

While card transactions offer a level of convenience for both businesses and customers, the time it takes for these transactions to settle can significantly impact a small business's cash flow. On average, card processing companies take between one to three business days to settle funds into a merchant's bank account. However, this timeline can vary depending on the provider and the specific agreement in place.

Understanding these settlement times is crucial for small businesses, as it directly affects their ability to manage day-to-day operations, pay suppliers promptly, and invest in growth initiatives. Businesses relying heavily on card transactions must factor in these settlement times when planning their finances to ensure a healthy cash flow.

Imagine if we could reduce those three business days, not to hours, or even minutes, but seconds...

And imagine if the transaction cost just 1p - irrespective of whether the merchant was being paid £10 or £10k.

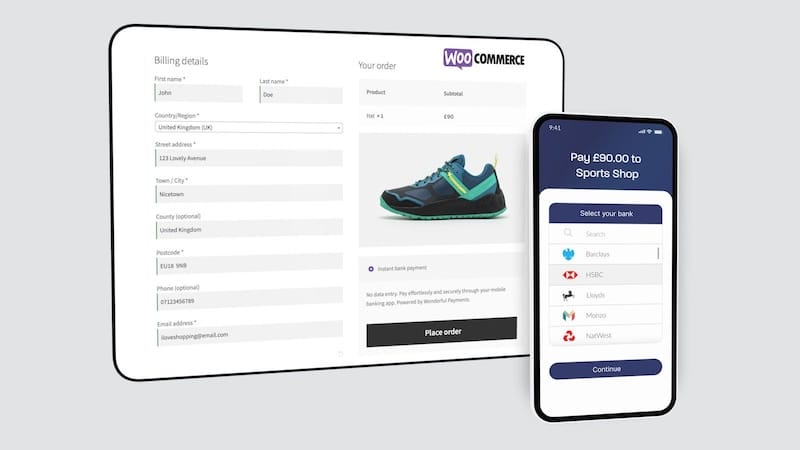

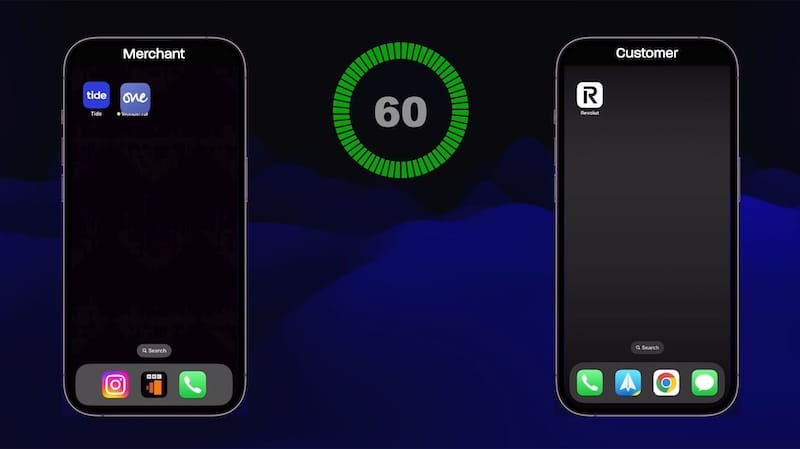

You no longer have to imagine. Open Banking allows Wonderful to deliver instant bank payments which are simple, fast and secure to UK merchants - online or offline. The video above shows a payment link being generated, shared to a remote customer via SMS, then being authorised, paid and settling to the merchant's account in under 60 seconds.

What else can be done? navigating a path forward

So, what additional steps can small businesses take to navigate the challenges posed by delayed payments and settlement times?

Clear payment terms: Clearly outline payment terms on invoices to set expectations regarding due dates and penalties for late payments.

Leverage technology: Utilise invoicing software that sends automated reminders for overdue payments, streamlining the process and reducing administrative burden. (Check out our Xero integration, for example.)

Negotiate with providers: When engaging with card processing companies, negotiate settlement times that align with your business needs and cash flow requirements.

Advocate for prompt payment: Encourage a culture of prompt payments among clients and partners, fostering mutually beneficial relationships and ensuring a healthier cash flow cycle.

Prompt payment of invoices is not merely a financial transaction; it’s a lifeline for small businesses. By adhering to timely payment practices and understanding the nuances of settlement times in card transactions, small businesses can pave the way for sustained growth, resilience, and long-term success in the challenging economic landscape.

By fostering a collective commitment to prompt payments, we can fortify the foundation of small businesses and empower them to thrive, contributing positively to the vibrant UK economy.