5 of the cheapest online payment systems for UK businesses

Kingsley Ohia - 13th Dec, 2022

With the wide variety of online payment solutions available today, we take a look at some of the most cost-effective options...

Online payment systems are evolving rapidly in the UK. Making sure your checkout experience is simple, fast and secure for your customers is critical to maximising revenue generation, but the costs of payment processing can vary quite dramatically, especially for larger transactions.

The good news is, recent developments in alternative payment methods mean online businesses can provide fantastic payment experiences whilst making significant savings on payment processing fees.

What is an online payment system?

Online payment systems or 'payment gateways' are third-party services that allow retailers and service providers to take online payments from their customers. As well as facilitating the checkout process, these systems usually allow businesses to search and filter transactions, initiate refunds, send receipts via email and more. Most payment gateways can be integrated seamlessly into an existing checkout flow.

Are there any free payment gateways in the UK?

Currently, there are no truly free payment processing services available to UK businesses. We found an extremely small amount of services which claim to be free, such as Super Payments, but once you dig a little deeper there is almost always a cost.

However, many UK businesses are making savings on transaction fees by supplementing the traditional credit / debit card payment model with alternative payment methods.

What constitutes payment processing costs?

The costs associated with processing payments may include:

- A fixed fee per transaction

- A percentage fee per transaction

- Platform / subscription fees

- Set-up fees

Percentage fees: The real sting?

If cutting costs is a priority, businesses can gain a lot by minimising percentage fees. A move away from this traditional percentage-based charging model can represent real savings, especially for larger transaction values.

For a £50.00 payment, a typical debit / credit card fees might be 1.4% + 20p. Even for this relatively modest transaction, the percentage fee of 70p dwarfs the fixed fee of 20p. On larger purchases percentage fees can become significant. For a payment of £360, this 1.4% fee becomes £5.04.

5 of the cheapest online payment systems

Here we've provided a range of options to suit different requirements and payment types, with a focus on minimising costs.

For Open Banking payments

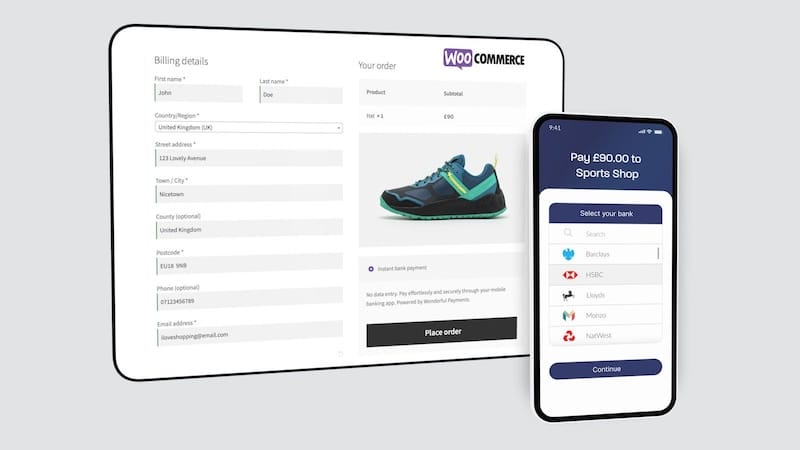

In the vast majority of cases, Open banking payments offer significant cost savings compared to card payment gateways. Open Banking payments, don't involve cards at all. Instead, they connect your customer with their existing online / mobile banking app so that they can authorise a secure payment directly to your business bank account.

These Open Banking payments may also be referred to as 'instant bank payments', 'easy bank transfers', 'A2A (account-to-account) payments' or 'Payment Initiation Services'.

Wonderful

Wonderful is a purpose-driven payment gateway that brings more than just instant bank payments at an attractive price point. It also provides its service free to any UK registered charity, so as well as saving costs, Wonderful customers help to process millions in charitable donations across the UK.

Wonderful provides a cost comparison tool to demonstrate the savings that can be made over traditional card payment providers like Stripe and PayPal.

£9.99/month for up to 1,000 transactions | No percentage fees | Alternative plans for higher volumes (greater savings)

Start your free trial today!

GoCardless

Stripe is a well-established provider offering lots of functionality, integration options and competitive card processing fees. Much like Wonderful, GoCardless pioneers the cost-busting and conversion-boosting benefits of instant bank payments. It also offers recurring payments and custom branding options for an additional monthly fee. However there is still a percentage fee on every transactions, which may not be the most cost effective solution for higher-value transactions.

1% + 20p | No set-up fees | Optional monthly fees for additional features (custom branding)

For card payments

If taking payments via credit or debit card is a must, there are lots of options to choose from. Processing fees can vary quite dramatically so it's worth comparing costs.

Stripe

Stripe is a well-established provider offering lots of functionality, integration options and competitive card processing fees. Pricing is kept simple and there are no additional fees for extra functionality. Stripes great reporting features come out-of-the-box.

1.4% + 20p / transaction | No set-up fees | No monthly fees

WorldPay

In contrast, popular payment provider WorldPay charges significantly more per transaction than Stripe. However, it also offers a monthly payment option which can offer savings at higher volumes. WorldPay also supports PayPal payments, although these are subject to PayPal's higher rates.

2.75% + 20p per transaction (pay as you go) | No set-up fees | £19 - £45 monthly fees (greater savings)

For when you need more than just payments

The payment systems above focus on payments alone (payment gateways) and they require some technical knowledge to integrate. However, if you're looking for something that can provide much more, such as website hosting, stock management and even shipping, there are some great options available. As you might expect, these all-in-one platforms are more costly due to the additional functionality they offer.

Shopify

Compared to some other all-in-one eCommerce solutions like WooCommerce, Shopify offers good value. The platform has grown rapidly in recent years, with features to support everything from marketing to website templates, online payments and even point-of-sale systems (for in-person payments).

2% + 25p / transaction | No set-up fees | £19 - £259 monthly fees for additional features

Introducing One: Instant bank payments, in your pocket

One is a simple and intuitive mobile app that allows businesses to slash transaction fees, bill for any product or service, and request instant payments via QR codes or secure links. Up to 1,000 transaction, for just £9.99 per month (that's just 1p per transaction).