QR code payments for UK businesses: A simple guide

Gabi James - 1st Jun, 2023

It's a payment method that's becoming increasingly popular, and for good reason. Find out how your business can delight customers, and slash transaction fees with QR code payments.

Can UK businesses take payments from customers using QR codes? Absolutely, and there are a number of advantages to doing so. Here we cover some of the best QR code payment solutions available today, and how you can ensure QR codes can provide a slick payment experience for your customers and a cost-effective solution for your business.

How QR code payments work

A QR code is a simple, square, bar code-type image that can be scanned using almost any smartphone camera. In most cases, QR codes link to a particular web page, instantly opening in the user's mobile browser.

Since the Coronavirus pandemic, contactless technologies such as QR codes have become more widely adopted, and this includes QR codes that allow consumers to make payments for products and services.

Why use QR codes to receive payments?

In short, QR codes can provide an extremely convenient way for customers to pay in lots of different situations. They usually require little investment from merchants because no additional hardware is needed, and they are extremely flexible in how they can be presented (printed on physical surfaces or documents or displayed on a screen). Qr codes also allow merchants to offer highly popular and convenient mobile-based payment technologies such as instant bank payments and digital wallets.

Also worth noting, the instant bank payments mentioned above allow merchants to slash transaction fees on sales, by eliminating credit / debit cards (and the fees associated with them) - more on that below!

Examples of QR code payments in action

In-person sales

Merchants are now using QR codes to accept payments from customers in face-to-face transactions. Instead of having to purchase and maintain additional hardware such as cash registers or credit / debit card readers, a seller can now present a QR code using their own mobile device, or print QR codes onto individual products/services, ready for their customer to scan and then complete payment on their device.

An art gallery might display QR-codes on individual pieces for sale, providing an extremely convenient way to pay when that hard-earned sale is made. A second-hand car dealer, might generate a QR code for a substantial purchase, so that their customer can scan and make an instant, secure bank transfer (whilst eliminating card processing fees for the merchant).

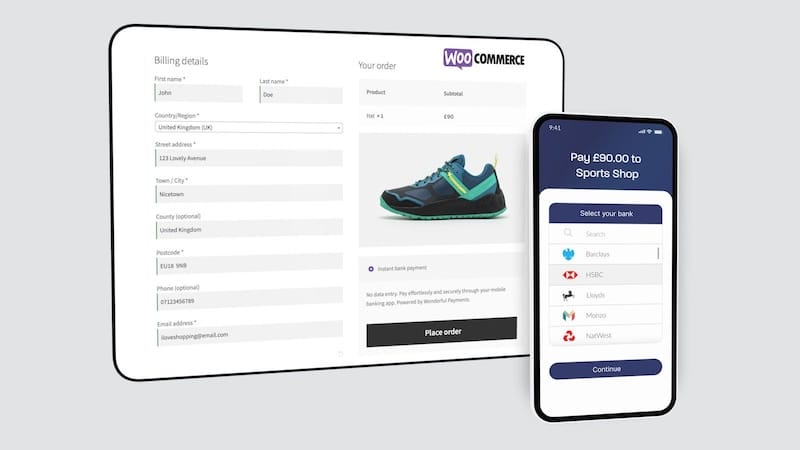

Remote invoicing / payment requests

Because QR codes are essentially unique image files, they can quite easily be added to specific invoices sent to customers. If a customer is viewing an invoice on a desktop computer or in paper format, they can quickly scan the QR code to complete payment for that invoice. Most QR code payment providers also provide secure links to take payments, which can be provided as an accompaniment to QR codes - in case the customer is already on a mobile device.

General payment collections and queue-busting

In any situation where a business needs to take payments of a specific amount from passing customers, or perhaps those watching a presentation or webinar, a QR code payment flow can be a fantastic and convenient option. Similarly, in market stall or restaurant-type interactions, QR codes are being used on banner displays or printed on tables so that customers can avoid asking for a bill or queuing to pay.

The main QR code payment mechanisms

These are the main ways businesses can use QR codes to take payments:

- Merchants generating permanent, reusable QR codes for specific amounts, which any customer scan and pay instantly.

- Merchants adding particular products / services to a digital 'basket', and then presenting a QR code to the customer to complete the purchase.

- 'Scan to shop' QR codes: Where customers scan first, and then add products or services to their order before paying through their mobile device.

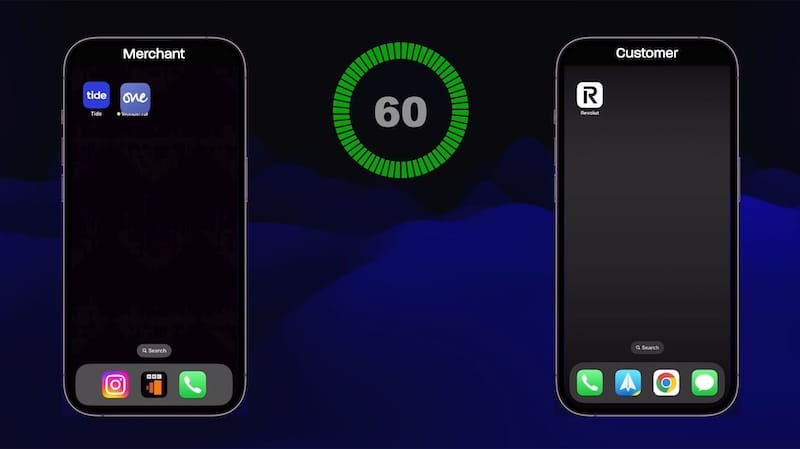

- 'App-to-app' QR payments: Where the customer pays by opening a particular app (such as Pay Pal) and scanning a merchant's QR code (also generated in the same app).

QR code payment apps for UK businesses - a quick round-up

One

The One app, from Wonderful Payments, allows customers to scan a QR code, select their bank, and then authorise an instant transfer to the seller's account. There's no manual data entry and credit / debit cards aren't involved, leading to substantial savings on transaction fees! Merchants can generate and present QR codes, or share secure payment links through messaging apps, emails and other channels. Find out more.

Fees: £9.99 / month including 1,000 transactions. (1p per transaction within and outside the bundle.)

PayPal

With PayPal's solution, the customer needs to have Pay Pal installed on their device. As long as they have the app, they can simply open it and scan the seller's PayPal Qr code. Their preferred payment methods in the PayPal wallet are then ready to be used. Find out more.

Fees: 1.5% + £0.10 per transaction over £10.00, and lower fees for transactions £10.00 and under.

Square

Square is an all-in-one style Point of Sale system with a number of QR code features. QR codes for different amounts can be quickly generated and shared online or printed. Square charges up to 2.5% on some payment methods, but is a great option for restaurants or shops wanting to allow customers to scan and then browse products, add to basket, and pay, all from their mobile device. Find out more.

Fees: 1.4% - 2.5% per transaction. Additional 25p per transaction for UK card payments.

FAQ

What is the maximum payment limit for QR payments?

This can depend on a number of factors, such as the payment method used as well as limits set by the customer's bank or card provider. If you're looking to take large payments from customers via QR codes, instant bank payments (powered by Open Banking) are a great option, as most UK banks support payments of up to £20,000 or more, and merchants can save big on transaction fees.

Why are QR code transactions cheaper?

In general, QR code transactions are cheaper for sellers because providers don't have to supply any substantial hardware (such as point of sale terminals / card readers). These savings can then be passed onto sellers by reducing transaction fees. If you're looking to cut costs, it's certainly worth considering Qr code payment providers, especially those that support bank payments, sometimes known as 'Account-to-account payments'.

How do I generate QR codes for my business payments?

To start making use of QR code payments, businesses can use an authorised payment providers (such as those mentioned above). Alternatively, it is possible to build your own solution using a QR code library, but this would require additional software engineering resources.