Conscious consumerism: Do good, do right, do well.

Kieron James - 8th Aug, 2023

The concept of conscious consumerism is not just another buzzword, but a driving force behind consumer choices and investor decisions. (Exactly how fast is fast fashion?)

Businesses are finding that success is no longer defined solely by profit margins and market share; rather, it is contingent on embracing Environmental, Social, and Governance (ESG) principles that reflect a commitment to doing good, doing right, and ultimately, doing well.

ESG: A road to success

In 2023, ESG has transitioned from being a nice-to-have, to a pillar of business strategy. Whether you're a start-up or a well-established enterprise business, aligning your operations with ESG values has become non-negotiable for attracting customers, securing investment, and retaining the very best talent. Gone are the days when adding a rainbow logo to your LinkedIn profile photo is enough to convince stakeholders; they now demand transparency, authenticity, and measurable positive impact.

Harvard's recent report underscores the inextricable link between ESG and business strategy, asserting that ESG considerations are not confined to compliance or simple philanthropy. Instead, they must permeate every level of the organisation, from the boardroom to daily operations. This shift heralds a new era of conscientious capitalism, wherein business leaders recognise that ESG integration is a core component of long-term success.

The digital revolution: Transforming ESG implementation

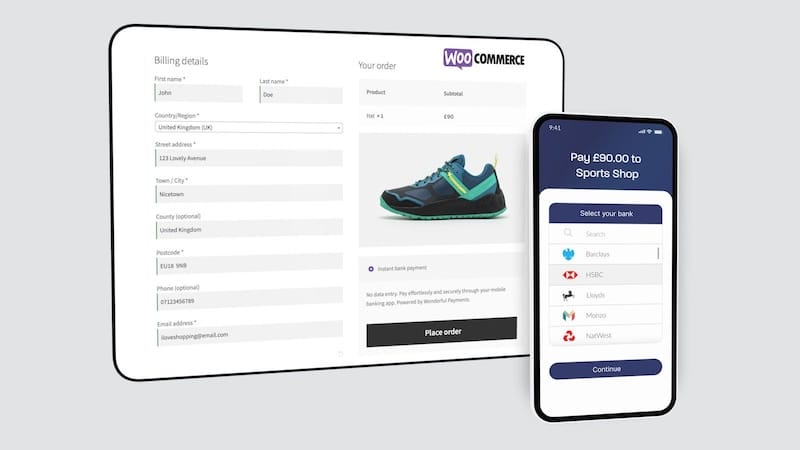

In the digital age, the fusion of technology and conscious consumerism has given rise to innovative opportunities for businesses to demonstrate their commitment to ESG principles. Fintech companies, such as our own, are at the forefront of this transformation, leveraging Open Banking payments services to integrate ESG values seamlessly into your online checkout and point-of-sale (POS) experience. Fintech as a force for good.

Big savings, real impact

Wonderful started life as a free online giving platform for UK charities. Initially funded by corporate sponsors (thank you to the Co-operative Bank!), it allows charities to receive every penny from the mud runs, cake bakes, triathlons and skydives raised by their passionate supporters. But the cost of processing donations made using prohibitively expensive debit and credit cards placed a low ceiling on Wonderful’s reach and impact.

Switching from cards to Open Banking payments not only removed this barrier to growth for the fundraising platform, it was also the catalyst for our own FCA authorisation. This in turn led to the development of commercial services to save businesses 90% or more on payment processing. Our move to instant bank payments, didn't just improve payment security and reduced friction, but crucially the savings we make when compared with card processing allow us to serve thousands more charities, donors and fundraisers.

And settlement is instant too. Rather than waiting days for funds to reach their bank account via the card networks, donations are made seamlessly and instantly from the donor’s bank account to the charity’s bank account. Wonderful initiates the payment, but never holds the funds. Of course, this is also true for our commercial customers. And at a time when cash flow is more important than ever, that’s great to hear!

Purpose is our DNA; impact our raison d’être. Our giving platform has always had one simple goal: to ensure charities receive every penny from the commitment and generosity of their supporters. This goes way beyond passive, feel-good, corporate giving. By covering the platform’s modest operating costs, our corporate sponsors created a huge multiplier effect, and it’s something we’re very proud of. You can see this in the impact made by its corporate sponsors – even before we implemented Open Banking and slashed our payment processing costs. Millions of pounds have reached charities with not a single penny deducted.

And now, Open Banking also allows our merchants and their customers to support good causes at no additional cost to either.

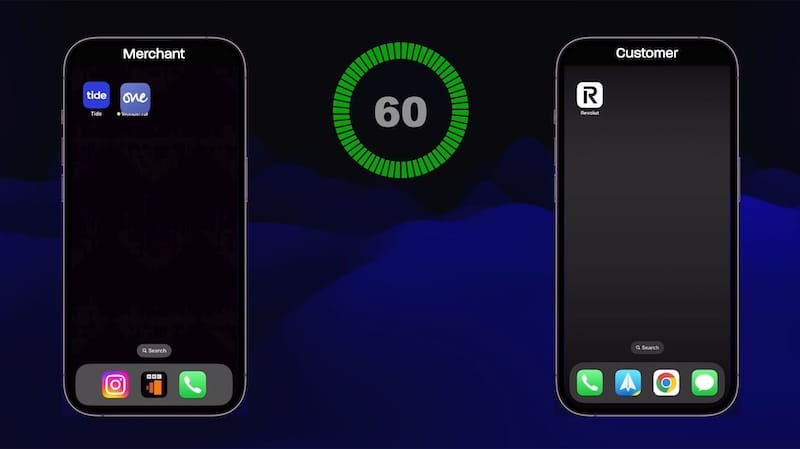

We have always provided (and always will provide) our services completely free to UK charities. But what does this mean for our commercial clients and their customers? Simply by adding Wonderful as an option at checkout or by using our POS instant bank payments app, One by Wonderful, ESG is embedded in your checkout process. You and your customers are supporting wonderful charities doing essential work in fields ranging from health, science and the environment to disability, poverty, human rights and international rescue. Or, as we like to say, you don’t need to run the marathon to be wonderful, you can just buy (or sell) the trainers.

Fostering ESG-centric partnerships

In the interconnected world of online commerce, forging strategic partnerships is also helpful in amplifying ESG impact. Fintech companies that provide ESG-integrated payment solutions can collaborate with like-minded e-commerce platforms, and other financial services, amplifying conscious consumerism. By joining forces, we can co-create campaigns, promotions, and initiatives that champion ESG values and drive collective change. If you’re in this space - as a merchant, consumer or potential partner, we’d love to hear from you.

ESG beyond profit: A vision for the future

People are capable of incredible feats – but belief is the cornerstone. Our name, aspirational in nature, encapsulates a principle that resonates within each of us, both as individuals and as a business. Wonderful emerged as a free online platform on Wonderful.org - grounded in our unwavering conviction that platforms for giving should mirror the dedication and commitment of the charitable causes and fundraisers they serve.

Our mission was resolute: we pledged to ensure that every penny raised found its way to the causes that hold a special place in the hearts of our supporters. No deductions. No fees. No virtual tip jars. The concept was straightforward, characterised by its complete transparency.

And here's the thing – that fundamental principle remains unshaken. Charities will forever benefit from a fee-free environment on Wonderful.org and we created Wonderful Payments with an equally clear objective for our commercial clients: to engineer a solution that is uncomplicated, swift, secure, and substantially more cost-effective than traditional card payments. This has been made possible through the transformative capabilities of Open Banking.

Yet, our enthusiasm is not solely rooted in harnessing the potential of Open Banking to deliver a simple, fast, secure and highly competitive payment service; it also extends to our deep appreciation for venturing into a future of marvellous uncertainty. As the true capabilities of Open Banking technologies materialise, we anticipate a paradigm shift as thrilling as it is unpredictable.

The combination of conscious consumerism and fintech innovation offers a transformative opportunity to redefine the role of businesses in society. ESG integration through Open Banking payments services is not merely a transactional tool; it is a conduit for driving positive change, empowering consumers, and shaping a more sustainable and equitable future.