Consumer Duty for Fintechs? It's our bedrock.

Kingsley Ohia - 10th Aug, 2023

Our customers are at the centre of everything we do. We are committed to embedding their interests at the core of our activities. On the 31st of July 2023 new FCA rules came into force.

Having been in the financial services industry for 20 years, I see this as a seismic shift in the expectations the Financial Conduct Authority has on firms like ours.

The FCA have positioned the Consumer Duty as a catalyst for positive change for retail customers with the overall expectation that it will ‘move the needle’ in terms of customer trust in the financial services sector. Customer care and treating customers fairly has long formed part of the components of delivering good service and outcomes to customers, but the Duty raises the bar and sets a much higher standard of consumer protection.

Expectations

As a customer, you should get:

• The support you need, when you need it.

• Communications you understand.

• Products and services that met your needs and offer fair value.

At Wonderful we aim to adhere to, implement, and uphold the standards set by the Consumer Duty in our services and activities. We are committed to treating our customers fairly, transparently, and ethically. We strive to ensure that our operations and business decisions do not merely appear compliant but genuinely advance the interests and welfare of our customers.

What the Duty means for customers

Helpful and accessible customer support – we are committed to providing customer support that enables consumers to realise the benefits of the products or services they buy from us which helps them to achieve their financial objectives and act in their own interests. We want to ensure that customers can act on the decisions they’ve made without facing unreasonable barriers.

Timely and clear information – we are committed to equipping consumers with clear, simple, and timely communications about our products and services, their features, risks, and the implications of any decisions they make. This includes providing crucial information at key decision-making points, such as at purchase, or during times of significant change.

Products and services that are right for you – we design products or services that meet the needs, characteristics, and objectives of our identified target market. We ensure our distribution strategy for our products or services is appropriate for our identified target market and we carry out regular testing and reviews to ensure that products or services continue to meet the needs, characteristics, and objectives of our identified target market.

Products and services to provide fair value – it is crucial for consumers to receive fair value for their money. The absence of fair value can prevent customers from achieving their financial objectives and getting good outcomes. We understand that the term, “fair value” is a multifaceted concept, encompassing not just price but also elements such as product features, communication, and customer support. Hence, we strive to consider value in the round, with the aim of consistently providing our customers with a high-quality offering at a fair cost. At Wonderful, we recognise the high standards of care expected from us by the Consumer Duty. It is our priority to consistently focus on customer outcomes and empower customers to make informed decisions that serve their best interests. This commitment shapes our culture, influences our behaviour, and is embedded throughout our organisation.

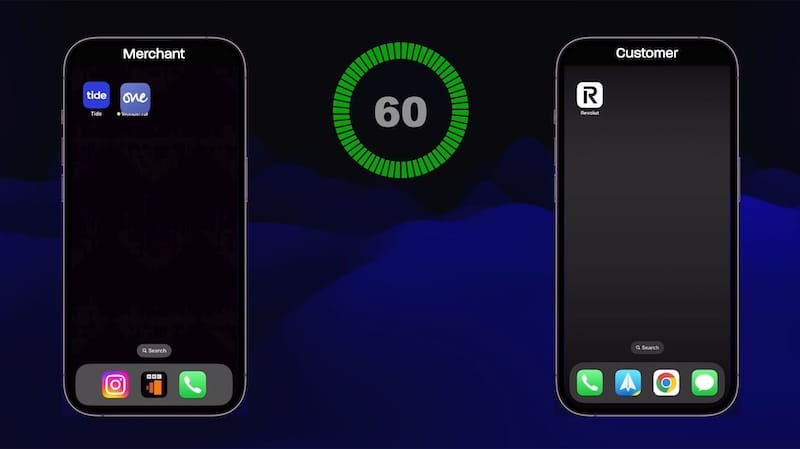

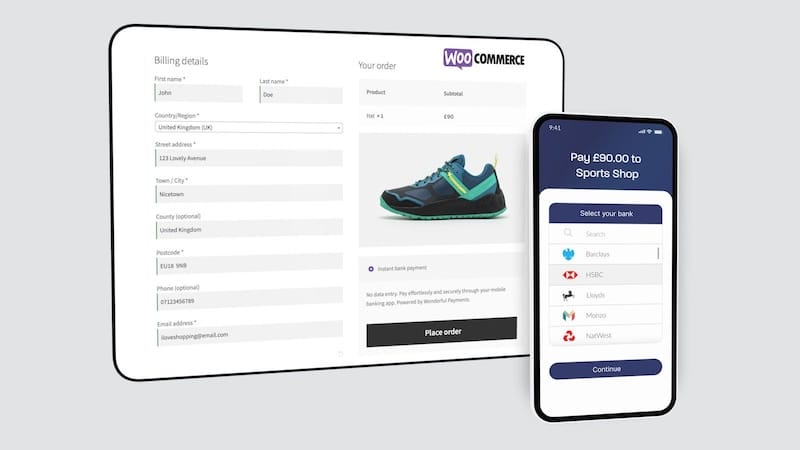

These principles were fundamental during every stage from design to launch of our payments App, One by Wonderful. Customers using our platform to accept charity donations, or businesses who want to deliver a seamless instant bank payments experience using One will see first-hand how the Consumer Duty has been integrated into our day-to-day operations as well as the overall culture of Wonderful.

Culture, Governance and Accountability:

Prioritise Customer Interests: We have put customer interests at the heart of our organisational culture and purpose. This fundamental focus guides our strategies, governance, and leadership.

Review and Assess Performance: Our board conducts an annual review and approval of an assessment on whether we are delivering good outcomes consistent with the Consumer Duty. This process enables us to monitor our performance and continually improve.

Promote Accountability: We hold high standards of personal conduct and individual accountability to guarantee our obligations under the Consumer Duty are fulfilled.

Drive a Positive Culture: We recognise that culture is a key driver in delivering good outcomes for customers. We uphold a culture centred on delivering good outcomes by focusing on:

Our Purpose: Our firm's purpose is in alignment with the Consumer Duty, ensuring that staff members understand their roles in delivering positive customer outcomes.

Leadership: Our competent and accountable leaders are committed to delivering good outcomes for our customers.

People: Our staff members are managed, trained, and rewarded in ways that promote and enable the delivery of positive customer outcomes.

Governance: We have established processes and controls that help us identify and address areas where we might not be delivering good outcomes for our customers.

Embed Customer-Focused Governance and Accountability: We ensure that customer outcomes are at the centre of our strategies, governance, leadership, people policies, risk management, and audits. Our board is responsible for embedding the Consumer Duty throughout the organisation.

Appoint a Champion: To ensure Consumer Duty remains a priority, we have appointed a champion who, along with the Chair and CEO, ensures the Duty is consistently discussed and considered in all relevant contexts.

Monitor and Improve: The board approves an annual assessment of whether we are delivering good customer outcomes, which are consistent with the Duty. This assessment includes reviewing the outcomes of our products and services, identifying areas of risk, planning necessary actions, and aligning our future business strategy with the Duty. This regular review ensures we remain proactive and responsive to our customers' needs.

As we strive to adhere to the Consumer Duty, we encourage a culture of questioning and constant improvement. We regularly review and address questions around our culture, governance, and customer outcomes. This enables us to continually reflect on our performance and identify areas of potential growth and improvement.