Payment Initiation Services: A game changer for UK businesses

Kimberley Smith - 26th Jan, 2023

Payment Initiation Services allow businesses to accept instant bank transfers from customers, transforming the checkout process and improving security.

What is a Payment Initiation Service?

A Payment Initiation Service (PIS) is a third-party service that connects customers to their existing online/mobile banking app to authorise a pre-populated, instant bank payment from their bank account.

Payment Initiation Services avoid the need for consumers to share credit/debit card details with retailers and other service providers. Instead, the customer is simply handed over to their banking interface, with the payment details (recipient, amount etc.) clearly displayed and ready for authorisation.

Payment Initiation Services are operated by Third Party Providers (TPPs). These firms are strictly regulated by the Financial Conduct Authority to keep financial data safe. TPPs must also obtain customers' explicit consent before initiating payments, clearly laying out the full details of a payment before redirecting the customer to their bank for authorisation.

How do Payment Initiation Services work?

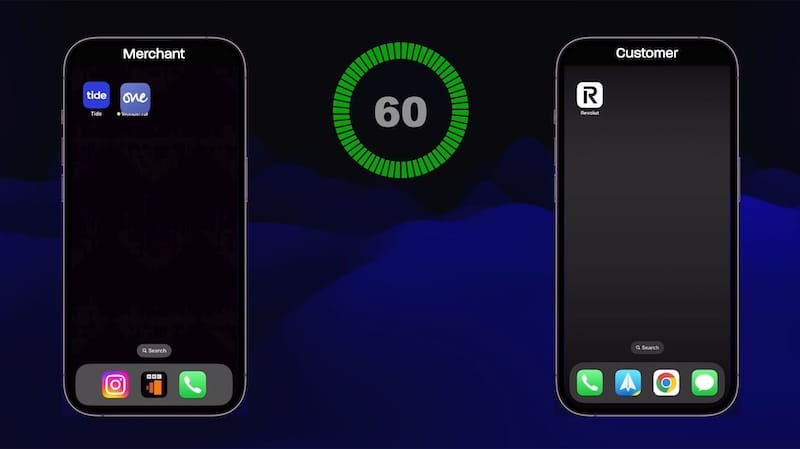

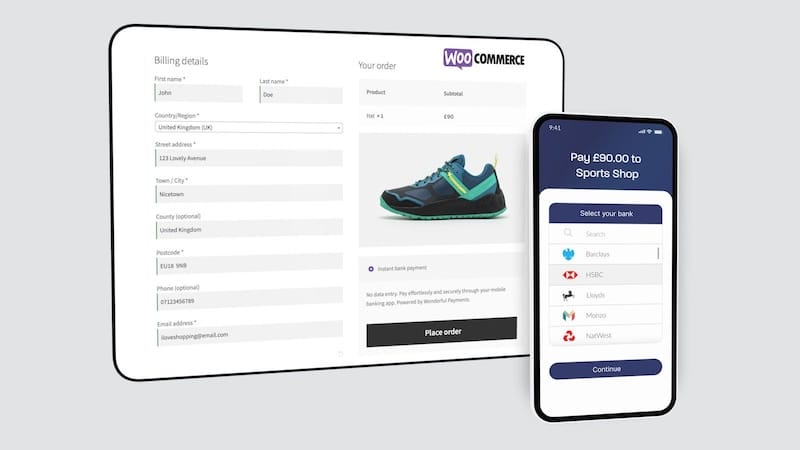

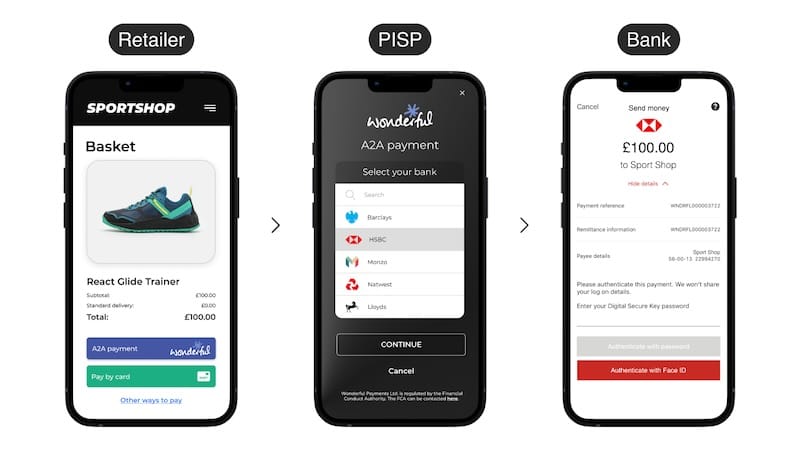

When a customer is ready to pay, they will usually be presented with a range of payment methods to choose from. If the retailer or business has integrated with a Payment Initiation Service Provider, this payment option will typically be described as 'Pay by Bank', 'Account-to-account (A2A) Payment' or 'Instant Bank Transfer'.

If the customer chooses this option, they will be asked to select a bank from which to make their payment. After selecting their bank and reviewing the payment information, the customer is connected to their banking app or online banking interface, where they log in in the usual way. Each bank's interface may vary slightly, but the buyer will already be familiar with the process of reviewing and authorising a payment. Once the payment is authorised, using an industry-standard Strong Customer Authentication process (which usually includes PIN-entry or Face ID), the buyer is then returned back to the business/retailer website or app and presented with their purchase/order confirmation.

Payment Initiation Service Providers serve as a go-between for merchants and banks. They facilitate direct instant bank payments between consumer and merchant accounts through Application Programming Interfaces (APIs). These payment APIs are built and maintained by the banks and TPPs themselves and every participating provider must conform to the same Open Banking API specifications and security standards. APIs make these instant bank transfers possible and the growth of Open Banking, which securely makes bank APIs available to regulated third parties and their business customers, is fuelling significant innovations within the online payments space.

Why were Payment Initiation Services introduced?

PIS provides a convenient payment experience for consumers and simultaneously reduces associated fees for the business. It gives consumers greater control of their payment experience, and does so in a safe and seamless manner. PIS also generates competition in the financial services industry by driving demand for cheaper, faster, and easy-to-use payment experiences.

PIS were made possible thanks to the introduction of the European Commission's Second Payment Services Directive (PSD2). PSD2 aims to improve consumer choice when it comes to financial services, boosting competition and growth in the financial services industry. Historically, incumbent banks have maintained a monopoly on consumers' financial data, which has made it difficult to standardise processes across the industry and give consumers control of their financial data. Today, PSD2, facilitated by Open Banking, is leading to increased competition across a range of financial services in the UK.

What are the benefits of Payment Initiation Services?

- Payments are faster and easier because there is minimal data entry and all payment details are pre-populated;

- They improve consumers' confidence because every payment is securely authorised in their existing mobile/online banking app;

- They present a significant opportunity for retailers and other businesses to reduce costs associated with payment processing.

- They can help businesses resolve payment disputes before they escalate, eliminating chargebacks entirely.

How can businesses start using Payment Initiation Services?

PIS are readily available to businesses who choose to integrate with a regulated Third Party Provider (TPP). The Open Banking directory provides a secure way for prospective businesses to find and liaise with all registered TPPs.

As an authorised PISP, Wonderful Payments allows businesses to receive direct, account-to-account payments from their customers, whilst also supporting UK charities with 100% fee-free donation payments and fundraising tools.

How should businesses choose a Payment Initiation Service Provider?

Various factors come into consideration when businesses decide on which PISP to use. Coverage may be a key focus, and the range of banks that the business has integrated may be a determining factor.

Additionally, the ethics and values of the business may discourage or encourage which provider to choose. Wonderful, for example, takes pride in ensuring fee-free donations for those supporting charities on the platform. This guarantee that every penny goes directly to the desired recipient is one example of the many factors that may be considered when choosing a PISP.