Two floor elevator ride

Kieron James - 29th Nov, 2022

Last week, I was showing a friendly VC our pitch deck when a slide on routes to market made her pause and ask: “could you explain the benefits of Wonderful payments to a commercial prospect in ten words?”

Last week, I was showing a friendly VC our pitch deck when a slide on routes to market made her pause and ask: “could you explain the benefits of Wonderful payments to a commercial prospect in ten words?”

Ten felt like a turbocharged elevator, but the challenge made me realise how simple our offering is. So simple we had two words to spare:

Slash fees, remove friction, improve security, be wonderful.

For those who are happy to take the stairs, let me elaborate:

Slash fees

Why should you hand over a percentage of your hard-won revenue every time a transaction is processed for your business?

Debit and credit card networks dominate the payments landscape, both online and in-store. They are also expensive. For decades, there have been no viable or competitively-priced alternatives. But now, Open Banking clears the way for a much better deal.

At Wonderful, we’ve harnessed the simplicity, speed and security of Open Banking account-to-account (A2A) transactions. And we have done so by creating highly affordable, inclusive plans to make the cost of payment processing predictable, fair and equitable.

Remove friction

When you’ve invested so much time refining your UI/UX to ensure a smooth customer journey, the last thing you want is an abandoned cart. But according to recent research, almost one in five of those who give up do so due to long, complex checkout processes. That’s four times the number that abandon because their payment has declined.

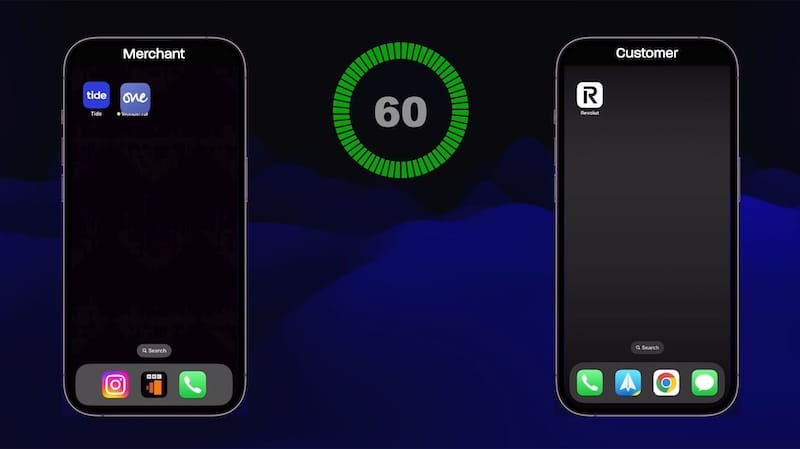

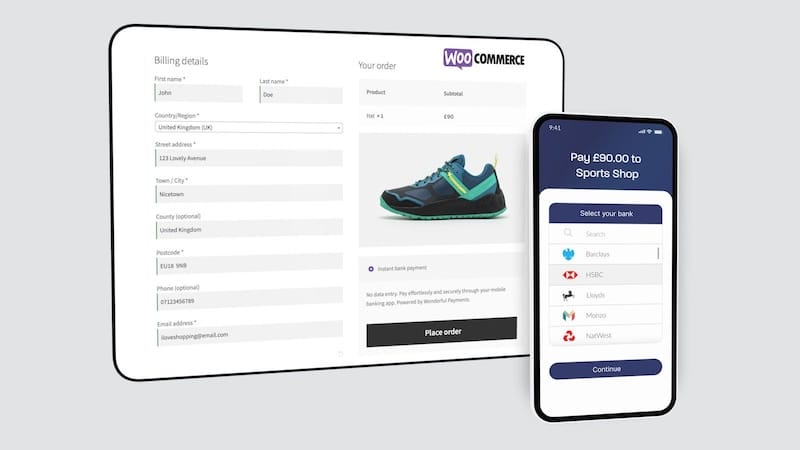

Checking out with Wonderful is quick and easy with just two steps for your customers to complete:

- Select their bank;

- Confirm the payment in their mobile banking app.

With no transaction data to enter, they simply review the amount / recipient in a secure and familiar environment – their mobile banking app – and tap to authorise.

Improve security

We understand the importance of data security: for your customers and your business. Taking only the UK and only 2021, more than 40 million people had their financial data compromised. This poses significant risk to your reputation and – more importantly – to your customers. And of course, the regulatory fines for this kind of data breach are, quite rightly, punitive.

To counter these risks, debit and credit card transactions require additional steps for Strong Customer Authentication (SCA) – such as one time passwords (OTPs) sent via SMS. On the other hand A2A payments remove the need for your customers to provide financial data in the first place, making our transactions secure by design.

Be wonderful

By offering your customers Wonderful at checkout, your business benefits from a direct association with our strong and celebrated tech-for-good stance. Here's how:

Back in 2016, we began life as an online giving platform at Wonderful.org. We always insisted – and always will – that charities receive every penny from the fundraising efforts of their supporters. To this end, Wonderful.org was completely free, its operating costs covered entirely by corporate sponsors. However, after three years, the prohibitive cost of card-processing was placing a hard ceiling on the reach and impact of our platform. We were forced to explore alternatives.

Open Banking not only offered a solution, it highlighted just how outdated the existing model had become – from an e-commerce perspective, it’s clunky and expensive. The problem we were solving was not limited to charities. It was ubiquitous.

Wonderful Payments was born with a mission to improve transparency, reduce costs and simplify payments for commercial organisations, while simultaneously supporting the work of our incredible third sector.

Now – true to our goal of expanding the virtuous circle of charities, donors and fundraisers – buyers and sellers can also create real impact simply by using Wonderful at checkout. Better still, they do so at no cost to the former and considerable savings for the latter.

Or as we like to say, you no longer have to run a marathon to be wonderful. You can simply buy (or sell) the trainers!