Software Spotlight Podcast 🎙️

Kieron James - 11th Mar, 2024

At Wonderful, we're thrilled to share that our CEO and Co-Founder, Kieron James, was recently featured on the Software Spotlight podcast. Hosted by Michael Bernzweig of Software Oasis, the podcast provides a front-row seat to the latest innovations in software for small businesses.

Wonderful CEO Kieron James shares insights on the Open Banking revolution.

Each week, executives from leading software companies share their insights on emerging technologies, business strategies, and market trends shaping the future.

Discovering a solution to high payment processing costs

In the exclusive interview, James discusses the journey that led to the creation of Wonderful and its innovative open banking payment solution. The idea was sparked in 2016 when James' son encountered high payment processing costs while fundraising for a teenage cancer charity. This led to the development of wonderful.org, a completely free online giving platform initially funded by corporate sponsorship.

However, as the platform's popularity grew, the costs associated with card processing limited its impact and reach. "We started to look for a solution because we thought actually this is creating this really low ceiling on our impact and reach," James explains. "We can only grow so large and reaches many charities and fundraisers and donors as card processing allows us to reach."

The power of Open Banking

The solution presented itself in the form of open banking.

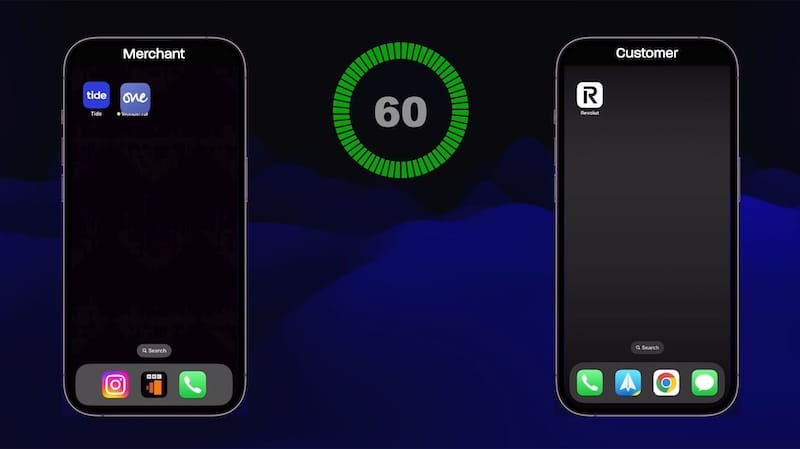

"What basically happened when we discovered open banking was that we found a method of moving the donors money from their account to the charity's account in one tap on a mobile phone or a couple of clicks on a laptop,"

James describes.

"And essentially, that money was moved directly from that account into the charity's account with only one intermediary rather than several intermediaries."

Open banking enables direct bank-to-bank transfers, bypassing the credit card processing networks and their associated fees. "It was basically a bank to bank transfer but a super simple very secure an immediate transfer with a fraction of the costs associated with cards," James notes.

A seamless user experience and significant cost savings

From a consumer perspective, open banking offers a much more streamlined payment process compared to traditional card transactions. Instead of entering card details and going through multiple verification steps, the user simply selects their bank and authorizes the payment within their familiar mobile banking app.

For merchants, the cost savings are substantial. While major card processors in the UK typically charge around 1.4% per transaction plus 20 pence, Wonderful has eliminated the percentage fee entirely and reduced the flat fee to just 1 penny per transaction. "It's a penny a transaction with no percentages," James confirms. "So that gives you a sense of, in our scenario, it's probably a lot more than 90% saving."

Expanding to Serve UK Small Businesses

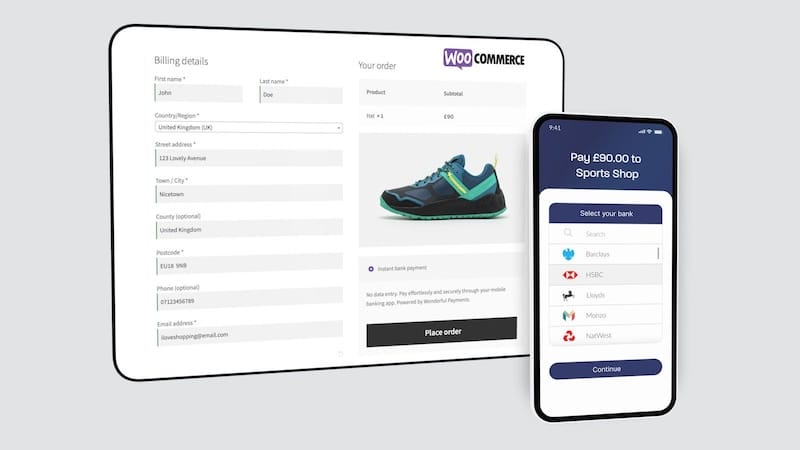

Currently launched in the UK, Wonderful is focusing on the charity sector but is expanding to serve the country's 5.5 million small businesses. The company recently integrated with WooCommerce on WordPress, making its open banking solution available to UK merchants.

At Wonderful, we're excited to be at the forefront of this transformation in payments. By leveraging open banking, we're providing a secure, instant, and cost-effective solution for businesses and charities alike.

Do also check out host, Michael Bernzweig’s software learning hub for SMEs, subscribe to his newsletter and take a listen to his excellent and extensive library of podcasts at Software Oasis.