Open banking payments integration

Carmen James - 13th Sep, 2023

The intersection of finance, technology, and commerce has created genuine payments innovation. Open Banking, a concept that emerged as a result of the Second Payment Services Directive (PSD2) in Europe, has been a game-changer in the financial industry.

It allows customers to initiate payments securely via FCA-authorised third-party providers known as Payment Initiation Service Providers (PISPs), like Wonderful, through Application Programming Interfaces (APIs), offering numerous advantages to consumers and businesses alike. Open Banking has been the catalyst for huge strides in e-commerce, offering UK merchants many benefits.

We explore the pivotal role of e-commerce and accountancy integrations in Open Banking payment providers and sheds light on the advantages for UK merchants who embrace this innovation. Wonderful Payments has a strong tech-for-good heritage. How does it contribute to this evolving landscape.

The significance of eCommerce and Accountancy integrations

Streamlined payment flow

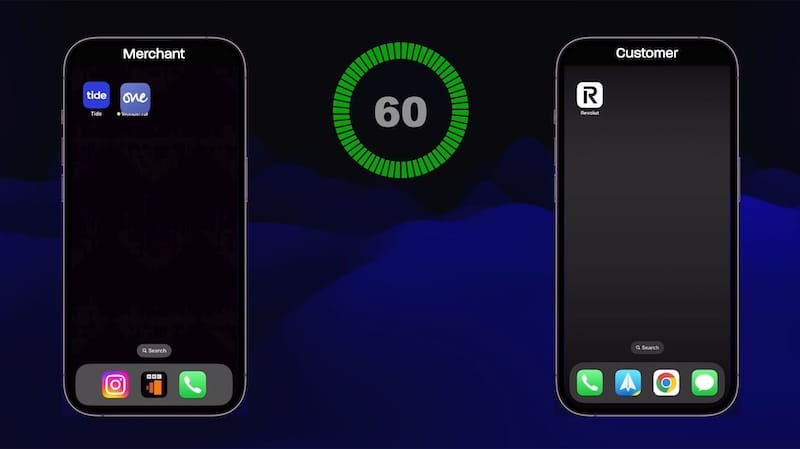

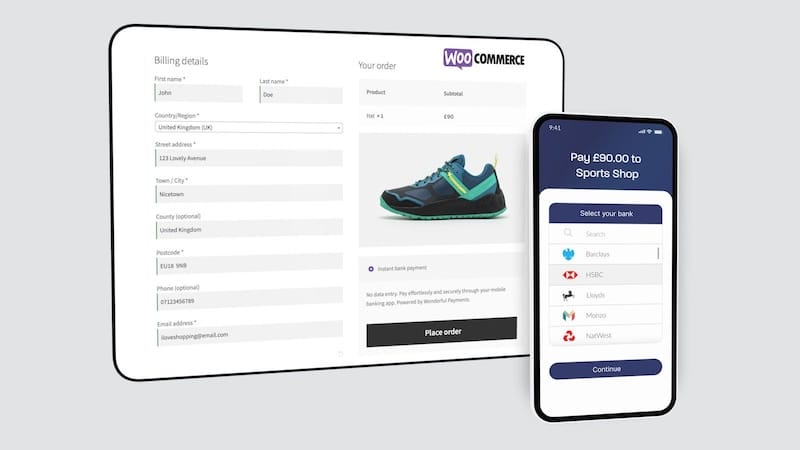

Open Banking payment providers, when integrated with e-commerce platforms, enable merchants to streamline their payment processes. Through these integrations, customers can initiate instant bank payments directly from their bank accounts, bypassing traditional card networks and payment gateways. This not only reduces transaction costs but also simplifies the payment journey, enhancing the user experience. For merchants, this translates to increased efficiency and a higher likelihood of visitor to customer conversion.

Enhanced security

Security is paramount in eCommerce transactions, and Open Banking payment providers excel in this aspect. By leveraging bank-grade security measures and encryption protocols, these providers offer a level of protection that surpasses traditional card payments. Accountancy integrations further enhance security by automating the reconciliation of financial data, reducing the risk of errors and fraud. UK merchants can rest assured that their customers' financial information remains safeguarded.

Real-time data access

Open Banking APIs provide real-time access to customer financial data, allowing merchants to make data-driven decisions. Accountancy integrations can sync seamlessly with e-commerce platforms, enabling merchants to monitor cash flow, track expenses, and analyse sales data in real time. Real-time information empowers businesses to adapt to market trends, optimise pricing, and make informed financial decisions.

Improved customer experience

One of the most significant benefits of integrating Open Banking payments into e-commerce is enhanced customer experience. With simplified payment processes, customers can make quick and secure payments directly from their bank accounts. Accountancy integrations can also automate recurring payments, making it convenient for customers and reducing the risk of late payments for merchants. This improved customer experience fosters loyalty and can lead to higher customer retention rates.

Regulatory compliance

Open Banking is subject to strict regulatory frameworks, ensuring that customer data is handled securely and transparently. Accountancy integrations can help merchants maintain compliance by automating reporting and auditing processes. This not only saves time and resources but also mitigates the risk of non-compliance penalties.

Benefits for UK Merchants

Now that we understand the significance of eCommerce and accountancy integrations in Open Banking payment providers, let's delve into the specific advantages for UK merchants:

Cost savings

Open Banking payments typically come with lower transaction fees compared to traditional card payments. By embracing this payment method, UK merchants can significantly reduce their payment processing costs. This cost-saving can be a game-changer for small and medium-sized businesses, allowing them to allocate resources more efficiently.

Faster settlement

Traditional card payments often involve delays in settlement, which can affect a merchant's cash flow. Open Banking payments, on the other hand, offer faster settlement, with funds typically reaching the merchant's account within minutes. This agility enables businesses to reinvest their earnings more quickly and seize growth opportunities.

Expanded customer base

Open Banking payments can cater to a broader customer base. By allowing customers to pay directly from their bank accounts, merchants can cater to individuals who prefer not to use credit cards or those who do not have access to them. This inclusivity can help UK merchants reach new customer segments and boost sales.

Enhanced data insights

The real-time data access facilitated by Open Banking and accountancy integrations empowers UK merchants to gain valuable insights into customer behavior and financial performance. By analysing this data, businesses can refine their marketing strategies, tailor product offerings, and make data-driven decisions to stay competitive in the market.

Sustainable growth

Wonderful Payments' tech-for-good heritage aligns with the values of many UK merchants who aim to contribute positively to society. By adopting Open Banking payments, these businesses can position themselves as forward-thinking and environmentally conscious - and support UK charities using Wonderful's free online giving platform at no additional cost to merchant or customer. Open Banking payments reduce the reliance on physical cards, leading to fewer plastic card productions and lower carbon footprints. Ditch the plastic, lose the fees!

In the evolving landscape of financial technology and eCommerce, the synergy between Open Banking payment providers and eCommerce and accountancy integrations illustrates the power of innovation. UK merchants can reap a multitude of benefits by embracing Open Banking payments, from cost savings and enhanced security to improved customer experiences and sustainable growth.

As a key player in this space, Wonderful Payments' tech-for-good heritage adds an extra layer of credibility and trustworthiness to the equation. By aligning with a provider like Wonderful Payments, UK merchants can not only enhance their payment processing capabilities but also contribute to positive societal and environmental changes.

Get started today with a free trial.