Better payments: the greatest opportunity for Open Banking?

Gabi James - 15th Mar, 2022

Whilst Open Banking offers so much potential for innovation through the sharing of bank account data, the greatest advantage of this new scheme right now could be its ability to revolutionise online payments.

Since its introduction in 2018, Open Banking has been described as something that's about our data, or more specifically, our financial data and how it can be safely shared with (and between) financial service providers with our consent. As stated at the very top of the Open Banking website, the scheme enables banks and other financial service providers to "simply and securely exchange data to their customers’ benefit".

Whilst this focus on data does well to encompass everything Open Banking is and could be, it fails to describe the practical benefits to consumers and businesses, including better payments.

Arguably, Open Banking's potential to revolutionise the digital payments system is the most valuable outcome for individuals and industries alike.

What better means

Today, new tech fuels a relentless desire for so many aspects of our lives to be more convenient and more connected. Open Banking payments are a fantastic example of this trend. By drastically improving the ease with which payments can be initiated to online retailers and service providers.

When buying products and services online we've become used to a small number of payment methods. Most commonly, we reach for a debit card and begin entering in a series of payment details. If we're lucky, the website we're using will support a digital wallet or account-based payments service like PayPal, making the checkout process less clunky.

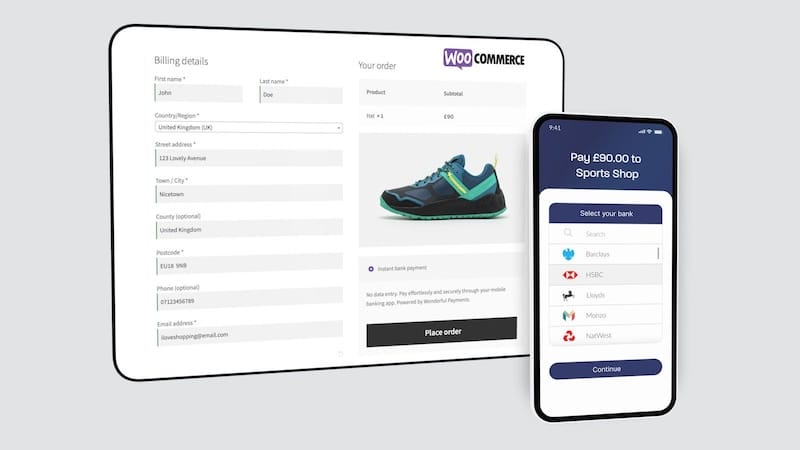

Open Banking brings us a far more standardised and democratised solution. This new and highly convenient way to pay doesn't require customers to enter card details and isn't subject to card processing fees, which businesses have become so used to shouldering.

Instead, Open Banking payments allow the customer to choose from a wide selection of banks, and securely authorise their transaction inside their mobile banking app. In line with today's consumer demand for ultra convenient and fast user-experiences, there's often no manual data entry at all, thanks to the biometric (face ID and fingerprint) security features of most smartphones.

How convenient?

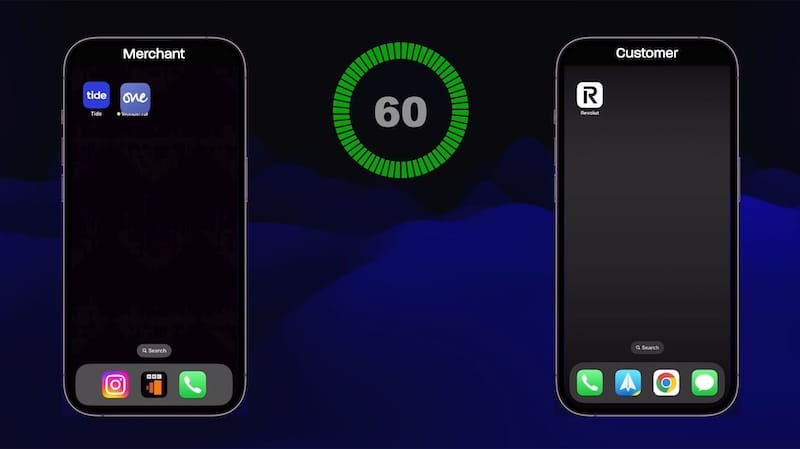

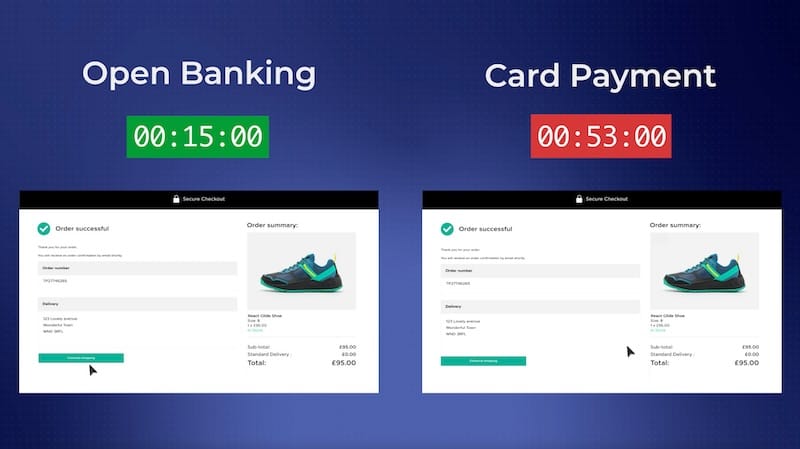

As an illustration, the video below compares the user-experience of an Open Banking payment with that of a traditional debit / credit card payment.

We can clearly see some of key pain points with entering card details manually, including mis-keying long card numbers and having to go back and make corrections.

In contrast, the Open Banking user breezes through the checkout process, without having to enter any details to authorise the payment. A quick scan of the QR code brings them to their mobile device and their chosen banking app. If the user doesn't use mobile banking, they can still continue on their desktop by logging into their online banking service.

Rapid adoption

Open Banking payments have been growing rapidly with some large institutions and businesses now offering this new payment method. In just 12 months (through 2021) the number of payments made via Open Banking grew by 500%.

For customers, these A2A (account-to-account) transactions require less effort, but are also more secure and trusted thanks to the fact that they are using their existing online / mobile banking app.

For online shopping sites and other businesses, not having to collect and store sensitive payment data is a real security benefit. Not to mention the cost savings that result from the removal of card processing fees.

As large businesses and organisations like Cazoo and HMRC spearhead adoption, we can expect continued growth and awareness of Open Banking as the new and better way to pay.