Cash - the lifeblood for small business

Kimberley Smith - 28th Sep, 2023

Running a small business can be incredibly rewarding, but it also comes with its fair share of challenges. Among these challenges, managing cash flow stands out as one of the most critical aspects of ensuring your business's survival and success.

Cash flow is critical for any business, but especially small ones. Whether you're a seasoned entrepreneur or just starting your small business journey, understanding the significance of cash flow is essential to your business's financial health.

Let's get started. What is cash flow?

Cash flow is the movement of money in and out of your business over a specific period. It's not just about having enough money in your business bank account; it's about the timing of your income and expenses. Essentially, cash flow reflects your business's ability to pay bills, cover operating expenses, and seize opportunities. When you provide a product or service, getting paid quickly is critical to your business success - so instant settlement to your business bank account would be a major win.

For small businesses, cash flow management is like juggling balls, with each ball representing financial elements like revenue, expenses, accounts payable, and accounts receivable. To maintain a healthy cash flow, you need to keep these balls in motion, ensuring a steady stream of incoming cash to balance out your outgoing expenditures. Delayed payment disrupts that motion, sometimes with catastrophic consequences.

Background - the UK small business landscape

Let's take a closer look at small businesses in the context of the broader UK economy. Small and medium-sized enterprises (SMEs) play a pivotal role, contributing significantly to employment, innovation, and economic growth. According to data from the Federation of Small Businesses (FSB):

- There were approximately 5.9 million SMEs in the UK in 2020.

- SMEs accounted for 99.9% of all private sector businesses.

- SMEs employed approximately 16.8 million people, representing 61.5% of all private sector employment.

- SMEs had a combined annual turnover of £2.3 trillion, contributing 51% of all private sector turnover.

These statistics underscore the critical role of small businesses in the UK economy. However, they also highlight the importance of effective cash flow management for this large and diverse group of enterprises.

The need for quick payments in the UK

Late or delayed payments can severely impact a small business's ability to cover its expenses, pay its employees, and invest in growth. Unfortunately, late payments are a persistent issue in the UK, affecting countless small businesses. Here are some key data points:

Late payments impact cash flow: The FSB reported that in 2020, 62% of small businesses in the UK were impacted by late or frozen payments, resulting in cash flow challenges.

Average payment delays: The payment delays faced by small businesses can be substantial. In the same FSB report, it was found that, on average, payments to small businesses were delayed by 23 days beyond agreed terms.

Financial strain: Late payments can place significant financial strain on SMEs. In a survey conducted by BACS Payment Schemes Limited (Bacs), it was revealed that UK SMEs were owed an estimated £23.4 billion in late payments in 2020.

Impact on growth and employment: Delays in receiving payments can hinder a small business's ability to invest in growth, hire new employees, or even maintain their current workforce.

This highlights the urgency of addressing late payments in the UK, as they directly affect financial stability of small businesses.

The critical importance of cash flow for small businesses

Survival and sustainability: Cash flow is the primary determinant of whether your business can survive in the short term and thrive in the long run. Without sufficient cash flow to cover operational expenses, your business may be at risk of closure.

Managing day-to-day operations: Cash flow ensures that you can meet your daily operational needs, such as paying rent, utilities, and employee salaries. A consistent cash flow enables smooth operations and fosters a sense of security.

Seizing opportunities: Opportunities for growth, whether it's expanding your product line, entering new markets, or acquiring assets, often require upfront investment. Adequate cash flow allows you to seize these opportunities when they arise.

Dealing with unforeseen expenses: Business is full of surprises, and not all of them are pleasant. Unexpected expenses, such as equipment breakdowns or sudden regulatory changes, can be handled more effectively with a healthy cash flow.

Investor and lender confidence: If you ever need external financing, be it from investors or lenders, a positive cash flow history demonstrates your business's ability to manage its finances responsibly and repay borrowed funds.

Buffer against late payments: In a climate where late payments are common, a robust cash flow acts as a buffer, allowing your business to weather periods of delayed income.

Strategies for improving cash flow

Accurate cash flow forecasting: Create a detailed cash flow forecast that includes both income and expenses. Regularly update this forecast to ensure you have a clear picture of your financial position.

Invoice promptly and clearly: Send invoices promptly and make sure they are clear, concise, and contain all necessary information. Consider offering incentives for early payments.

Set clear payment terms: Clearly define payment terms on your invoices, and communicate them to clients or customers upfront. This reduces the likelihood of misunderstandings and late payments.

Streamline receivables: Implement efficient accounts receivable processes to reduce the time it takes to collect payments. This may include automated invoicing and reminders.

Manage payables: Negotiate favourable payment terms with suppliers and vendors. Be diligent about paying bills on time to maintain good relationships and avoid late fees.

Cut unnecessary expenses: Regularly review your expenses and identify areas where you can cut costs without compromising the quality of your products or services.

Emergency fund: Establish an emergency fund to cover unexpected expenses and bridge gaps in cash flow during lean periods.

Explore financing options: Consider short-term financing options like business lines of credit or invoice factoring to cover cash flow gaps.

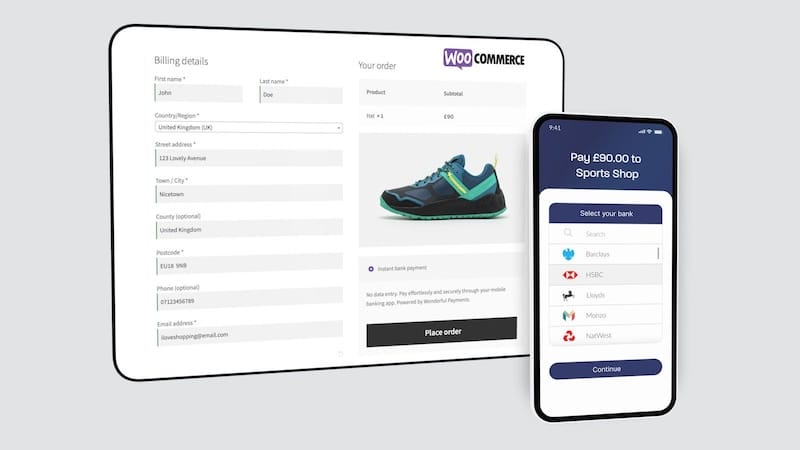

Instant settlement: Find a payments provider that settles in the shortest possible time. By selecting an instant bank payment service, such as that offered by Wonderful, there are no intermediaries holding onto your cash when you need it most. The moment your customer pays you is the moment the money is in your account and ready for you to put it to the best possible use.