VIP lounge anybody? Well, if you're paying...

Kieron James - 30th Sep, 2023

Like every other business, card providers have long recognised the importance of attracting and retaining customers. To achieve this, they employ various strategies, with loyalty schemes being a prominent and effective tool. But who foots the bill?

Credit card rewards schemes are enticing for shoppers, but for the companies these shoppers buy from, it’s not all sunshine getaways and free lollipops. In fact, these schemes are problematic in two key ways for businesses across the board: diluting their hard-earned customer loyalty, and ultimately cutting into their revenue.

Firstly, these schemes foster loyalty to the middleman – the credit card company – rather than to the business actually providing the goods or services which merit loyalty.

Secondly – and perhaps most alarmingly – somebody has to foot the bill for all the incentivising perks that credit cards offer. And who’s forking out to keep your customers spending indiscriminately on their credit cards? You guessed it: your business.

Those percentage fees and per-transaction charges that get taken out of every payment you receive also encourage your customers to shop elsewhere, to fly using air miles, to redeem vouchers with other retailers, and myriad other ‘rewards’.

But there’s a better way. Cut out this costly middleman altogether. You’ll be able to plough the money you save back into expanding your business – and perhaps even creating your own generous rewards scheme to keep customers coming back!

Attraction and retention

Rewards points: Credit card companies offer customers rewards points for every purchase made using their cards. These points can be redeemed for rewards, such as cashback, air miles, gift cards, or merchandise. The allure of accumulating points encourages customers to use their credit and debit cards more frequently.

Sign-up bonuses: To attract new customers, credit card companies often offer enticing sign-up bonuses. These bonuses typically include a substantial number of initial rewards points or a cashback bonus after reaching a spending threshold within the first few months of card ownership.

Tiered programs: Many credit cards have tiered loyalty programs, where customers earn more points or receive better rewards as they spend more. This tiered structure motivates cardholders to increase their spending to reach higher reward levels.

Exclusive benefits: Some credit cards provide exclusive benefits like airport lounge access, concierge services, or insurance coverage for travel and purchases. These perks add value to the card and encourage customers to keep using it.

Engagement - with you, or your payment provider?

Credit and debit card companies understand the importance of customer engagement and retention. As do you.

Consider whether the offers, rewards and communications your customers receive from your payment provider help you to engage and retain customers too.

Personalised offers: Credit card companies use data analytics to understand cardholder spending patterns. They can then tailor personalised offers and promotions to encourage cardholders to use their cards for specific types of purchases or with particular merchants.

But nothing is more personalised than your offer or incentive. After all, who knows their customer best: you, or the company your customer used to pay you?

Communication: Regular communication with cardholders, such as monthly statements, email newsletters, or notifications through mobile apps, helps keep customers engaged. These communications often include special offers or reminders about accumulating rewards points.

Again, they are your customers. What direct benefit do your derive from your payment provider's newsletter?

Anniversary rewards: Some credit cards offer anniversary bonuses, rewarding cardholders for their continued loyalty and card ownership. This encourages customers to continue or extend their relationship.

Use the savings you make on payment processing through simple, fast and secure alternatives to card payments to fund your own anniversary rewards, or indeed any other incentive schemes you wish to introduce or extend.

Once you're no longer handing over a percentage of revenue from every sale, the substantial savings you'll make on payment processing can be put to very effective use.

Costs and funding of loyalty schemes

Ultimately, it is you (and your customers) that fund debit and credit card loyalty schemes through:

Interchange fees: Credit card companies earn a significant portion of their revenue from interchange fees. These fees, typically a percentage of the transaction amount, form part of the revenue allocated to funding loyalty schemes.

Annual fees: Some credit cards charge annual fees to cardholders, especially for premium or rewards-heavy cards. The revenue generated from these fees can help cover the costs of loyalty programs.

Interest charges: Credit card companies also generate revenue through the interest charges imposed on cardholders who carry a balance from month to month. The interest paid by these customers contributes to funding rewards programs.

Card companies offer a variety of rewards programs, ranging from access to airport lounges and air miles (which we're all paying for one way or another) through to exclusive experiences and cashback. These loyalty programs are often linked to partner banks and financial institutions that issue branded credit and debit cards. They also have a financial interest in loyalty to the card brands.

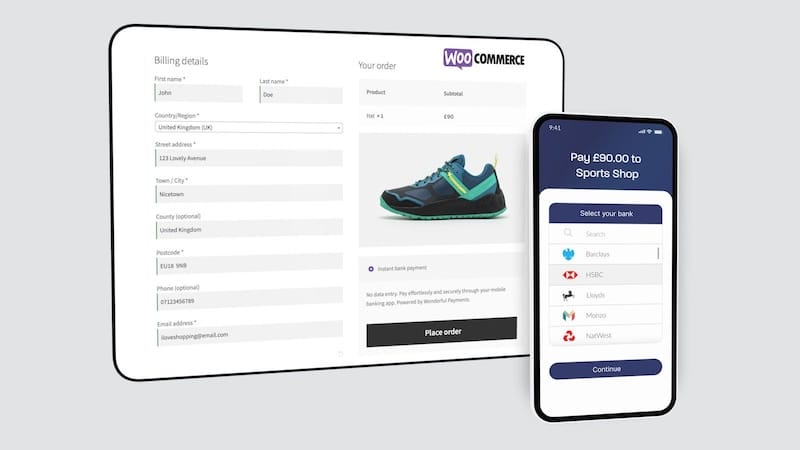

Reduce payment processing costs by introducing instant bank payments. Put those savings to the best possible use - improving customer engagement and loyalty to your business, rather than to your payment provider.

Unsure about Open Banking? Why not explore with a free trial?