Improve your WooCommerce store and increase profits

Gabi James - 28th Jul, 2023

One simple plugin could revolutionise your WooCommerce store, making your checkout experience effortless and saving you bundles on fees!

With zero percentage fees you'll slash your payment processing costs and watch the profit margins soar on your WooCommerce store. Find out more about Wonderful's easy to install plugin.

See our live demo at All Ears Audiobooks.

Savvy online retailers know they need to be constantly evolving and optimising to keep their business competitive in the ever-growing crowd of like-minded entrepreneurs. Plus, as a smaller business, keeping costs down is often high on the agenda.

Wonderful helps with all of this. We provide simple, secure Open Banking payments for a fraction of the cost of other payment methods. Have you ever heard of a provider going as low as 1p per transaction – with no percentage fees? That’s exactly what we offer: 1,000 monthly transactions included in your monthly Small Business Plan at just £9.99, and those made outside the bundle are still only charged at 1p per transaction. If you're integrating Wonderful into your WooCommerce store, there is an additional monthly integration fee of £9.99 for the WooCommerce plugin.

We don’t need to offer volume discounts because we discount for everyone. So unlike other payment providers, we don’t reserve our best prices for big businesses with thousands of sales per day.

On top of that, by adding Wonderful payments at checkout (our plugin is charged additionally at £9.99 per month), you’ll enjoy other enhancements to your WooCommerce store, like:

- Reduced friction;

- Instant payment;

- Improved security;

- Integration with existing payment methods;

- A positive impact on important causes.

Intrigued? Read on to find out how one simple change can revolutionise your WooCommerce shop.

What are Open Banking payments?

Let’s start at the beginning. What exactly can Wonderful provide for your WooCommerce enterprise?

We offer instant bank payments using the power of Open Banking – a financial initiative that first emerged as an idea in 2011. Today, there are 7 million users benefiting from Open-Banking-powered services, products and apps. And your business could soon be another…

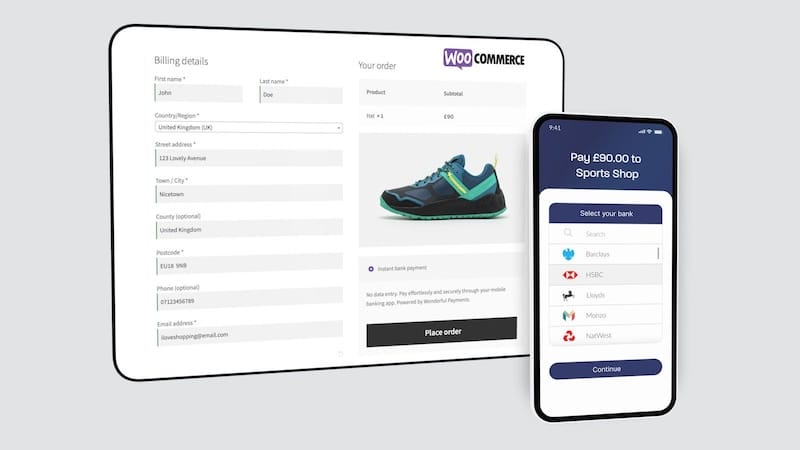

The way the payments work is deceptively simple. Instead of relying on bank cards or digital accounts linked to them (like PayPal), Open Banking transactions happen directly from the buyer’s bank account, within their online bank or mobile banking app. Just as if the customer were transferring money to a friend - except there's no data entry required at all (no accountholder name, account number or sort code to enter).

The buyer simply selects Wonderful at checkout, and they’re redirected to their own mobile or online bank. There, they’ll find the transaction pre-populated with the amount they’re paying and the recipient (i.e. your business bank account). They approve the payment in seconds using biometric (face ID / fingerprint) or any other security method they have applied to their mobile / online bank account, and the money moves instantly from their bank account to yours.

Simple, fast, and completely secure.

See it in action below:

Review your order... select your bank... authorise payment. Tap, tap, done.

How can Open Banking payments improve your WooCommerce store?

Now that we’ve covered the what of Open Banking payments, we can move on to the why – why should you offer them as part of your WooCommerce shop’s checkout methods?

First, we’re going to look at the critical question of your customers’ checkout experience. It is, after all, the bedrock of customer satisfaction and loyalty.

Huge savings

We’ve already touched on the first benefit that Open Banking payments provide: colossal savings.

As you know all too well, payment providers typically take big chunks out of your revenue. Take some of the providers you might currently be using on your WooCommerce shop:

Square

The processing rate for transactions varies according to the payment method, but for online transactions you’re looking at:

- 1.4% + 25p for online transactions with UK cards

- 2.5% + 25p for online transactions with non-UK cards

Stripe

Another widely used provider is Stripe. If you were using their integrated platform, their fees would be:

- 1.5% + 20p for standard UK cards

- 1.9% + 20p for premium UK cards (including all business and corporate cards)

- 2.5% + 20p for EU cards

- 3.25% + 20p for international cards outside of the EU

If currency conversion is required, there’s an additional 2% fee on top of the above.

Although they don’t advertise the fees for their WooCommerce plugin, we assume they are the same.

Wonderful

Now compare these to Wonderful transaction pricing.

We don’t use percentage fees, meaning you’re not penalised for increasing your AOV (Average Order Value) – something most of us are hoping to do!

And our per-transaction costs are also much, much lower. We give you:

- 1,000 monthly transactions for just £9.99, or;

- 5,000 monthly transactions for £49.99

In other words, regardless of the volume of transactions, you’re paying:

- 1p per transaction

If you go beyond that (congrats!) you keep that same rate of 1p per transaction.

Please note: to use our Small Business Plan with WooCommerce, you will also need our WooCommerce plugin, which is charged at an additional £9.99 per month.

So when we say a fraction of what other providers charge, we mean it – they’re taking 20p or 25p from every payment, on top of percentage fees.

You can imagine how these numbers start to add up over the weeks and years…

As an example, with an average volume of 500 transactions / month, and an average order value of £50, Stripe’s headline fees of 1.5% + 20p* would cost your business £375.20 / month.

In contrast, you’ll pay just £19.98 / month with Wonderful. That’s a whopping saving, which can be put straight back into growing your business.

*As of July 2023

A better checkout experience for your customers

Did you know that more shopping carts are abandoned than completed? Earlier this year, Baymard in 2023 found that the average cart abandonment rate for ecommerce retailers is a huge 69.82%! That means that if ten people put your products in their cart, only three of them will actually buy from you. That’s a lot of money to lose out on – altogether, about $18 billion every year.

Why do people leave all your great products in their cart? For 17% of them, it’s because the payment process is too complicated.

Perhaps even worse: almost half will never return to an online retailer if they have a negative checkout experience.

So there’s no doubt that making it as easy and quick as possible is absolutely crucial.

The fact is, in the days of contactless payments, few customers have the patience for long card numbers, CVVs, expiry dates, billing addresses… Instead, let them check out in seconds using Open Banking. You can see just how easy it is (and how much faster than the alternative) in the video below.

This seamless and secure checkout is sure to boost customer satisfaction and retention, and keep them coming back to your WooCommerce store for more.

Instant settlement on every payment

Another drawback of other payment networks is the long delays between a customer buying a product, and their money reaching you. Often, you have to wait several business days, and some popular providers only remit on a rolling weekly or monthly basis.

With profit margins shrinking while operating (and living!) costs rise, these delays are at best frustrating, and at worst plunge businesses into debt or halt their work altogether. Small businesses are often particularly at risk, as they tend to operate on smaller margins and have a less constant stream of sales.

And it’s not just about staying solvent. Having funds means flexibility, and that creates the opportunity to invest back into your business. You might be able to hire freelancers that boost your marketing efforts, take new product photos, or even prototype a whole new product. Relying on slow payment systems can cost you all of these opportunities, and who knows how many others.

One of the great things about Open Banking is that the payments move instantly from one bank account to the other – there’s no middleman handling the money, no cards to be processed, or any other intermediary steps or parties to factor in. Typically, your money hits your account as your customer approves the payment – usually a matter of seconds.

The most secure checkout option for your WooCommerce shop

If you want total confidence in the security of Open Banking transactions (because of course you want to protect your customers), there’s plenty of information to explore. To get started, you might have a look over Open Banking’s own website.

Or get a taste of the government’s level of support for Open Banking’s potential in recent policy papers, in which the Joint Regulatory Oversight Committee (JROC, formed of HM Treasury, the Competition and Markets Authority, the Financial Conduct Authority (FCA) and the Payment Systems Regulator (PSR) lay out a very optimistic vision for Open Banking’s future in the UK.

But the long and short of it is that account-to-account transactions powered by Open Banking are safer for customers and businesses than popular payment methods, because less financial or personal data is shared and every transaction benefits from inherent Strong Customer Authentication.

Because the payments are made directly from the bank, they benefit from bank-level security. On top of that, Open Banking uses rigorously tested software and security systems, and only apps and websites regulated by the FCA or European equivalent can initiate payments for customers.

Integration with your existing payment methods

While you’re probably sold on the benefits of Open Banking by now, it’s worth knowing that it doesn’t have to be all or nothing; you can add an Open Banking payment method to the roster of choices you already offer customers.

Lots of shoppers are used to seeing a handful of options at checkout – in fact, it’s pretty much what we expect to see. Nowadays, flexibility is key and shoppers want to be able to choose their preferred method for any given purchase.

So while you might already let customers checkout by manually entering their card details, using PayPal, Apple Pay, Google Pay, loyalty points, buy-now-pay-later schemes, or some other channel, you can just add Wonderful to the menu.

Adding Wonderful is straightforward and seamless, particularly with our new dedicated WooCommerce plugin. It's a simple as registering your business with Wonderful, installing our plugin via WordPress and enabling it on your checkout page.

So if you have any hesitations about disrupting the way your WooCommerce store operates, you can dispel them. By integrating Wonderful, you’re losing nothing and gaining a tremendous amount.

Your WooCommerce store can have a positive impact on the world

ESG might not be top of mind when you’re thinking about how to improve your WooCommerce shop, but perhaps it should be.

After all, one of shoppers’ main motivations for choosing small businesses is rooted in ESG. Many consumers shirk large corporations that they associate with environmental damage, social exploitation and a general lack of interest in anything but profits. They want to shop local to reduce their carbon footprint; they want to support small businesses with big ambitions; they want to buy from people who are doing it right.

And what better way to show them that’s the case than by putting your customer’s money where their mouth (and heart!) is?

Remember, the checkout is one of the most decisive points in forging your relationship with your customer. It makes sense: it’s the moment they give you their hard-earned money.

What if you can use that moment to solidify your strong ESG stance? And to reassure customers that their hard-earned money isn’t just going to a small, unique and trail-blazing business, but to one that supports other causes they care about?

You can – by choosing Wonderful, the payments provider with ESG baked in.

We began our work with Open Banking technology in 2020, to prove that fee-free fundraising is possible. And it’s something we’ve pulled off, with a resounding effect for charities across the country. Funded by corporate sponsors, our online giving platform at Wonderful.org has always been (and will always be) free for UK charities. It saves them thousands of pounds on processing and platform fees. And that means they have more funds to put towards the causes that desperately need them. As a result, Wonderful has become very popular in the third sector.

Now, businesses like yours – and their customers – can extend Wonderful’s impact simply by choosing this speedy, simple and secure payment method.

This ESG move is doubly smart, because it meets the growing demand for businesses we buy from to not only put something aside for one charity, but support lots of causes across a range of areas.

Of course, it’s unlikely your WooCommerce store can single-handedly battle the climate crisis, help people manage the cost of living, resolve wars and end discrimination. But the Wonderful Organisation does support charities and fundraisers across all of these areas. So by aligning your store with us, you’re covering your ESG bases and doing a world of good for countless causes. All while saving money, and making the checkout process swifter and safer for your customers!