How the JLR cyberattack exposed UK automotive supply chain risks and why EV growth now demands smarter payment systems

![]() Carmen James

-

Carmen James

-

The JLR cyberattack revealed deep vulnerabilities in the UK automotive supply chain just as EV growth accelerates. This analysis explores how cyber threats, supply disruptions, and outdated payment systems threaten the sector and why smarter financial resilience is essential.

When the Jaguar Land Rover cyberattack brought production to a standstill for six weeks, it didn’t just disrupt the UK's biggest car manufacturer; it exposed the wider automotive supply chain crisis. The JLR hack caused nearly £2 billion in losses and left over 5,000 suppliers facing cash flow uncertainty, raising urgent questions about how resilient UK car manufacturing really is in 2025.

This vulnerability comes at a critical time. The UK automotive industry is accelerating towards an electric vehicle future, with the EV transition reshaping manufacturing, component sourcing, and battery supply chains. As the move to electrification demands faster delivery cycles, real-time financial visibility, and cross-border coordination, many manufacturers are still relying on outdated payment systems that slow down supplier settlements and increase financial risk during disruption.

This is why payment innovation is becoming central to future-proofing the sector. Fintech platforms such as Wonderful Payments, powered by Open Banking, are helping automotive firms enable faster supplier payouts, improve liquidity during EV production, and build financial resilience after events like the Jaguar Land Rover shutdown. As the government invests in gigafactories and supports affected automotive suppliers, modern payment infrastructure is becoming a competitive advantage rather than just a back-office tool.

The UK auto industry is at a turning point. Those who modernise their payment technology now will not only recover faster from crises like the JLR cyberattack but also lead the next phase of the country’s electric vehicle revolution.

UK auto industry under pressure: Cyber threats, EV shift and supply chain risk

The UK automotive sector is facing one of its most turbulent periods in recent history. The Jaguar Land Rover cyberattack in August 2025 has become a defining moment, exposing how vulnerable even the country’s biggest manufacturers are to growing digital threats. As production lines stalled and suppliers were left waiting for payments, the incident raised serious questions about operational resilience and financial agility.

At the same time, the electric vehicle transition is accelerating. Record EV sales in 2025 and investment in new battery gigafactories across the UK have reshaped supply chains, introducing new dependencies on global partners, rare mineral sourcing, and complex cross-border financing. While this shift presents growth opportunities, it also places intense pressure on cash flow, supplier payments, and risk management.

Supply-chain fragility is now a major strategic concern. Many UK automotive businesses still rely on slow, batch-based payment processes that make it difficult to react quickly when disruption strikes. This is where financial technology and online payment systems are becoming critical tools for restoring confidence, improving supplier relationships, and protecting liquidity during periods of volatility.

No single incident has highlighted these pressures more clearly than the Jaguar Land Rover cyberattack, a turning point that revealed just how exposed the industry has become.

Inside the Jaguar Land Rover cyberattack and its ripple effects on the UK auto supply chain

In late August 2025, Jaguar Land Rover was hit by one of the most damaging cyberattacks in modern British industrial history. The incident forced a near six-week shutdown across major manufacturing sites in Solihull, Halewood, and Wolverhampton, with estimated economic losses nearing £1.9 billion. More than 5,000 suppliers were affected, bringing production lines, logistics, and payments to a standstill, exposing how fragile and interconnected the UK automotive supply chain has become.

A shutdown that rippled across the UK economy

Vehicle assembly ground to a halt, leaving thousands of unfinished cars in factories and delivery delays mounting. The shock was not contained to JLR. Tier-1 and Tier-2 suppliers experienced sudden production pauses, delayed payments, and severe cash-flow pressure.

Government steps in with financial rescue measures

Recognising the systemic risk, the UK government issued a £1.5 billion loan guarantee to stabilise JLR and prevent supply-chain collapse. JLR also secured an additional £500 million private loan to prioritise payments to smaller suppliers under financial strain.

Small suppliers faced the greatest financial pain

Many component manufacturers operate on thin margins and short payment cycles. With factories idle and funds tied up, some were forced to impose shift cuts, reduce staff wages, or warn of potential insolvency if liquidity did not improve quickly. The cyberattack demonstrated the urgent need for resilient supplier payment systems and real-time financial visibility.

A wider warning for the entire UK automotive sector

This attack arrived at a time when the industry is already undergoing rapid transformation due to the shift to electric vehicles. EV supply chains rely heavily on digital platforms, cross-border trade, and access to critical materials like lithium, increasing exposure to cyber threats, payment delays, and financial disruption.

A wake-up call for digital, financial, and supply-chain resilience

The JLR incident has made it clear that future-proofing the industry requires more than cybersecurity safeguards. Automotive firms will need secure, real-time payment technology, stronger supplier liquidity protection, and greater operational agility to absorb shocks during the UK’s transition to EV-led manufacturing.

Next, we explore how the rapid rise of electric vehicles is reshaping supply chains and why traditional financial systems are struggling to keep up.

The UK EV boom: How the electric transition is reshaping supply chains and financial systems

As the Jaguar Land Rover cyberattack exposed weaknesses in automotive supply chains, the UK industry is simultaneously undergoing a seismic transition towards electric vehicles. Record EV sales, new battery gigafactories and government-backed sustainability targets are reshaping how cars are built, financed and supplied and placing new pressure on payment and supplier funding systems.

Record EV adoption is accelerating change across the sector

Electric vehicle sales in the UK hit record highs in 2025, rising nearly a third year-on-year. In September alone, 72,800 battery electric vehicles (BEVs) were registered, according to the Society of Motor Manufacturers and Traders (SMMT). With growing consumer confidence, stronger charging infrastructure and zero-emission incentives, EVs are rapidly moving from niche to mainstream.

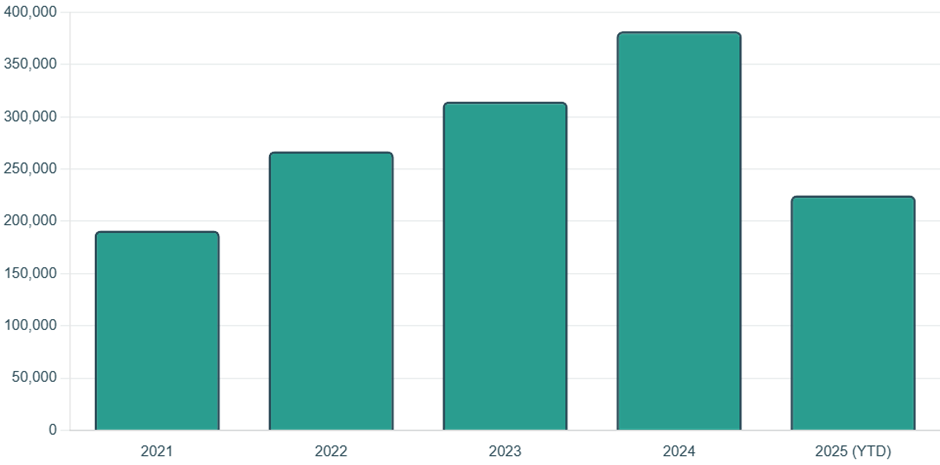

Annual BEV Registrations (2021–2025)

This chart shows the steep upward trajectory of new Battery Electric Vehicle (BEV) sales, with 2025 on track to set another record.

Source: WeCovr

As more consumers choose EVs, manufacturers are scaling production, onboarding new suppliers and restructuring logistics, increasing financial complexity across cross-border supply chains.

Government policies and gigafactory investments drive the EV revolution

The UK government’s 2030 ban on new petrol and diesel vehicle sales has intensified investment in EV production. Major players such as Tata Motors and AESC are establishing large-scale gigafactories, signalling strong confidence in the UK’s role in Europe’s EV supply chain. Tata’s multi-billion-pound battery plant investment, linked to Jaguar Land Rover’s future EV models, underscores a national push towards localised battery production and reduced import reliance.

EV supply chains require new levels of financial agility

EV production depends on costly components such as lithium-ion batteries, electric drivetrains and rare earth materials sourced from global markets. This creates pressure on manufacturers to support faster supplier onboarding, efficient cross-border payments and real-time financial visibility across multiple jurisdictions.

Why EV growth makes payment innovation mission-critical

With thousands of suppliers, many of them small and mid-sized, operating on tight cash cycles, any delay in payments can lead to production bottlenecks. Advanced payment platforms, supply-chain financing and FX-optimised cross-border transactions are becoming essential to maintaining supplier liquidity and preventing disruption.

As the UK’s EV transformation accelerates, automotive businesses that modernise their financial systems will be better positioned to scale, protect supplier relationships and remain competitive in this fast-moving market.

Policy shifts will also influence how automotive brands navigate 2026. The UK Autumn Budget 2025: What it means for businesses and key sectors outlines new incentives and regulatory changes for EV-dependent industries, adding further pressure on manufacturers and suppliers to modernise their financial and operational systems.

While cyber threats dominate headlines, the UK car sector autumn budget impact adds another layer of pressure to already fragile automotive supply chains. New EV-related tax changes and higher operating costs now intersect with cybersecurity risks, demanding smarter financial and operational resilience.

Now let's explore why payment innovation is no longer optional and how companies can future-proof their supply chains through financial resilience.

Payment innovation becomes critical to automotive survival and growth

As the EV transition accelerates and supply chains grow more complex, modern payment infrastructure is no longer a support function; it’s a strategic asset. Faster onboarding of new suppliers, real-time cash flow visibility and secure cross-border settlement are now essential to keeping production lines moving and protecting financial stability.

Platforms like Wonderful, which leverage open banking, instant payment rails, tokenisation and secure Pay by Link capabilities, enable automotive manufacturers to fund suppliers more efficiently, reduce friction in the purchase-to-pay lifecycle and build resilience against both cyber and operational shocks.

Why payment modernisation is now mission-critical for UK automotive

By integrating real-time payments, cross-border settlement and automated financial flows into manufacturing and supply-chain systems, firms can:

- Maintain liquidity across complex global supply networks

- Reduce delays caused by traditional banking bottlenecks

- Improve financial resilience in volatile market conditions

- Strengthen supplier confidence and trust

- Respond faster to production disruptions

This shift from static, batch-based payments to embedded, automated financial networks mirrors the industry’s digital transformation in production and logistics.

Key payment technologies driving automotive transformation

Several payment technologies are becoming critical enablers of resilience and efficiency within UK automotive supply chains:

- Real-time payments (e.g., Faster Payments, RTGS): Help manufacturers settle invoices instantly, reducing delays and preventing liquidity bottlenecks for suppliers.

- Digital invoicing and mobile POS solutions: Accelerate billing cycles, which is essential for just-in-time (JIT) manufacturing environments.

- Supply-chain financing and dynamic discounting platforms: Provide smaller suppliers with earlier access to funds, helping them manage cash flow and avoid financial stress during disruptions.

- Cross-border and FX-optimised payment solutions: Reduce cost and friction when sourcing key EV components from international suppliers.

- Embedded payments within ERP and manufacturing systems: Enable automated, seamless integration of financial flows into operational processes, reducing administrative burden and errors.

- Blockchain-based smart contracts: Offer secure, transparent, and automated settlement for high-value procurement agreements, particularly in EV battery and component production.

- AI-driven fraud detection, tokenisation, and multi-factor authentication: Strengthen cybersecurity in an increasingly digitised payment ecosystem. In fact, AI-powered global payment security systems reportedly prevented over $40 billion in fraud attempts in 2023 alone.

Lessons from the JLR cyberattack: Payments as a line of defence

Had Jaguar Land Rover and its supplier ecosystem adopted more agile, real-time payment solutions, the financial fallout from delayed settlements and disrupted liquidity could have been reduced. Faster access to funding or supply-chain finance could have prevented several tier suppliers from entering distress during the post-attack recovery window.

This incident has sparked a critical question across the UK industry: How quickly can automotive manufacturers now accelerate supplier payment modernisation to prevent future systemic shocks?

The answer forms the basis of the next section, a practical checklist designed to help UK automotive businesses assess, upgrade and future-proof their payment ecosystems for the EV era.

How to build a resilient payment strategy for the UK automotive sector

As the Jaguar Land Rover cyberattack proved, liquidity risk can ripple through a supply chain faster than a production shutdown. To stay competitive in a rapidly shifting EV-driven market, UK automotive firms must prioritise secure, real-time, and supplier-friendly payment ecosystems that protect cash flow, build trust, and ensure operational continuity.

Here’s a practical, future-ready payment checklist every automotive leader should consider.

1. Assess the resilience of your existing payment infrastructure

Start by reviewing your current payment setup. Are you still relying on delayed settlement methods such as legacy BACS cycles? Can your suppliers receive funds through Faster Payments or Real-Time Gross Settlement (RTGS)? A modern payment rail reduces bottlenecks, prevents liquidity crunches and builds confidence among suppliers, especially Tier 2 and Tier 3 partners.

2. Introduce early payment and dynamic discounting programmes

Supply-chain finance platforms can provide early payment access, letting suppliers receive payments ahead of due dates in exchange for a small discount. This supports smaller firms that operate on tight margins and helps stabilise production schedules during times of disruption.

3. Embed payment flows into ERP and manufacturing systems

By integrating online payment processing into existing ERP or manufacturing execution systems, firms can automate invoicing, approval and settlement flows. This creates a seamless link between production activity and cash movement, reducing manual errors and improving just-in-time manufacturing performance.

4. Strengthen cyber resilience across payment channels

Following the lessons from the JLR cyberattack, payment infrastructure must be cyber-secure by design. Implement multi-factor authentication, tokenisation, fraud detection analytics and continuous monitoring. Preventing payment disruptions is just as critical as protecting plant operations.

With UK automotive firms becoming more globally interconnected through EV supply chains, the next step is understanding how to streamline payments across borders, reduce FX exposure and support global supplier relationships.

How to build a cross-border payment strategy for global EV supply chains

As the shift to electric vehicles accelerates, UK automotive firms are sourcing more components from international suppliers, particularly batteries, semiconductors and electronic systems. This globalised EV supply chain places pressure not just on logistics, but on finance teams who must manage fast, secure, and cost-efficient payments across multiple currencies and regions.

Without a robust cross-border payment strategy, delays, FX losses and broken supplier trust can quickly derail production timelines.

Here’s how automotive businesses can future-proof their international payment flows.

1. Choose a payment partner with real-time data and analytics

A payment partner that provides real-time visibility into international payment flows helps finance teams spot bottlenecks early. Advanced analytics allow automotive firms to:

- Monitor supplier payment status instantly

- Identify delays before they affect production

- Track FX exposure across regions

- Improve cash flow forecasting in fast-moving EV supply chains

By turning payments into a data-driven process, firms can respond faster to supply chain risks and make better financial decisions.

2. Ensure multi-currency support with built-in FX risk management

With suppliers spread across Europe, Asia and North America, foreign exchange risk becomes a major concern. Automotive businesses need payment systems that:

- Support seamless multi-currency settlements

- Offer transparent FX pricing to avoid hidden fees

- Provide hedging options to lock in favourable rates

- Minimise conversion delays that could slow production

This ensures suppliers abroad are paid on time, helping maintain trust and keeping EV production lines moving without disruption.

With cross-border payment strategies in place, UK automotive firms are better prepared to support international supplier relationships, reduce financial risk and stay competitive in a fast-evolving EV ecosystem.

Next, we look at what the Jaguar Land Rover cyberattack has taught the industry about resilience beyond cybersecurity and deep into financial infrastructure.

The road ahead: Lessons from the JLR cyberattack for UK automotive

The October 2025 JLR cyberattack was more than a one-off crisis; it exposed systemic vulnerabilities across the UK automotive ecosystem. From delayed supplier settlements to disrupted production schedules, the incident highlighted how fragile financial and operational flows become when payment systems are outdated or decentralised.

As UK manufacturers continue to balance EV transition pressures, rising costs, and increasing regulatory scrutiny, the message is clear: modern, secure and real-time payments are now a core resilience strategy, not just a finance function.

The shift towards electric mobility only accelerates the urgency. With globalised EV supply chains, fluctuating FX rates, and tighter contractual timelines, payment efficiency, cross-border transparency and supplier liquidity now directly impact production continuity and profitability. Collaboration between OEMs, suppliers, policymakers and payment technology partners will define the sector’s ability to compete on a global scale.

Industry voices increasingly warn of financial fragility. As analyst Santiago Arieu of Fitch Solutions recently observed, “Brexit had a significant impact,” and as the UK pushes ahead with a sustainable EV roadmap, the winners will be those who align financial systems with digital-first, cyber-secure operations.

The lesson is clear: firms that act now, adopting real-time payment rails, tightening cybersecurity, embracing automation and integrating finance within supply-chain systems will be better positioned to protect production, improve supplier trust and seize first-mover advantage in the EV era.

This is a defining moment. Whether you’re an OEM, tier-one manufacturer or a smaller component supplier, modernising payment infrastructure is now central to securing resilience, accelerating the EV transition and building long-term competitive strength in the UK automotive industry.

FAQ: UK automotive, cybersecurity, EV supply chains and payment resilience

What happened during the JLR cyberattack in 2025?

The 2025 JLR cyberattack shut down production for almost six weeks, disrupting over 5,000 suppliers and costing the UK economy an estimated £1.9bn.

How did the JLR cyberattack affect UK automotive suppliers?

Many suppliers faced severe payment delays and cash-flow strain, with smaller firms at risk of collapse due to halted production and liquidity gaps.

Why are real-time payments important in the automotive supply chain?

Real-time payments keep suppliers paid quickly, prevent production delays, improve liquidity and protect smaller firms during disruptions.

How does the EV transition impact supply-chain payments?

EV supply chains are global and fast-moving, making cross-border, multi-currency payments and supplier finance critical to avoid costly delays.

What payment technologies are UK automotive firms adopting?

Manufacturers are shifting to instant payment rails, digital invoicing, supply-chain finance, tokenisation and FX-optimised cross-border platforms.

How can UK manufacturers protect against payment fraud and cyberattacks?

Automotive firms are using tokenisation, MFA, AI-driven fraud detection and embedded cybersecurity to safeguard financial transactions.

Why is FX risk management important in EV manufacturing?

EV components are sourced globally, so firms need strong FX strategies to avoid currency losses and ensure suppliers are paid on time.

What role does fintech play in supporting automotive suppliers?

Fintech platforms offer early-payment options, dynamic discounting and automated settlements, helping suppliers stay financially stable.

How can payment analytics improve supply-chain resilience?

Payment analytics track cash flow in real-time, flag risks, improve forecasting and allow faster decisions during supply-chain disruption.

What should UK automotive firms prioritise to build financial resilience?

They should adopt real-time payments, secure cross-border systems, integrate finance into ERP platforms and strengthen cybersecurity.