5 fantastic examples of A2A payments in action

Kingsley Ohia

-

A2A (account-to-account) payments are emerging as a fantastic alternative to card payments. Here we showcase some of the websites and apps already taking advantage.

Account-to-account, or instant bank payments allow people to pay for things without entering card details or other payment information. Instead, once the customer is ready to pay, they simply select their bank and are automatically transferred to their mobile or online banking app to authorise the transaction.

These Account to Account payments, also known as 'Pay by bank' or 'Easy bank transfers', can sit neatly alongside other online payment options at the checkout and offer a number of benefits over traditional payment methods.

Advantages of A2A payments

- A slick user experience with minimal data entry;

- Bank-grade security (because payments are authorised in customers' online/mobile banking apps);

- Greatly reduced transaction fees (which businesses love).

To see A2A payments in action, take a look at the examples below.

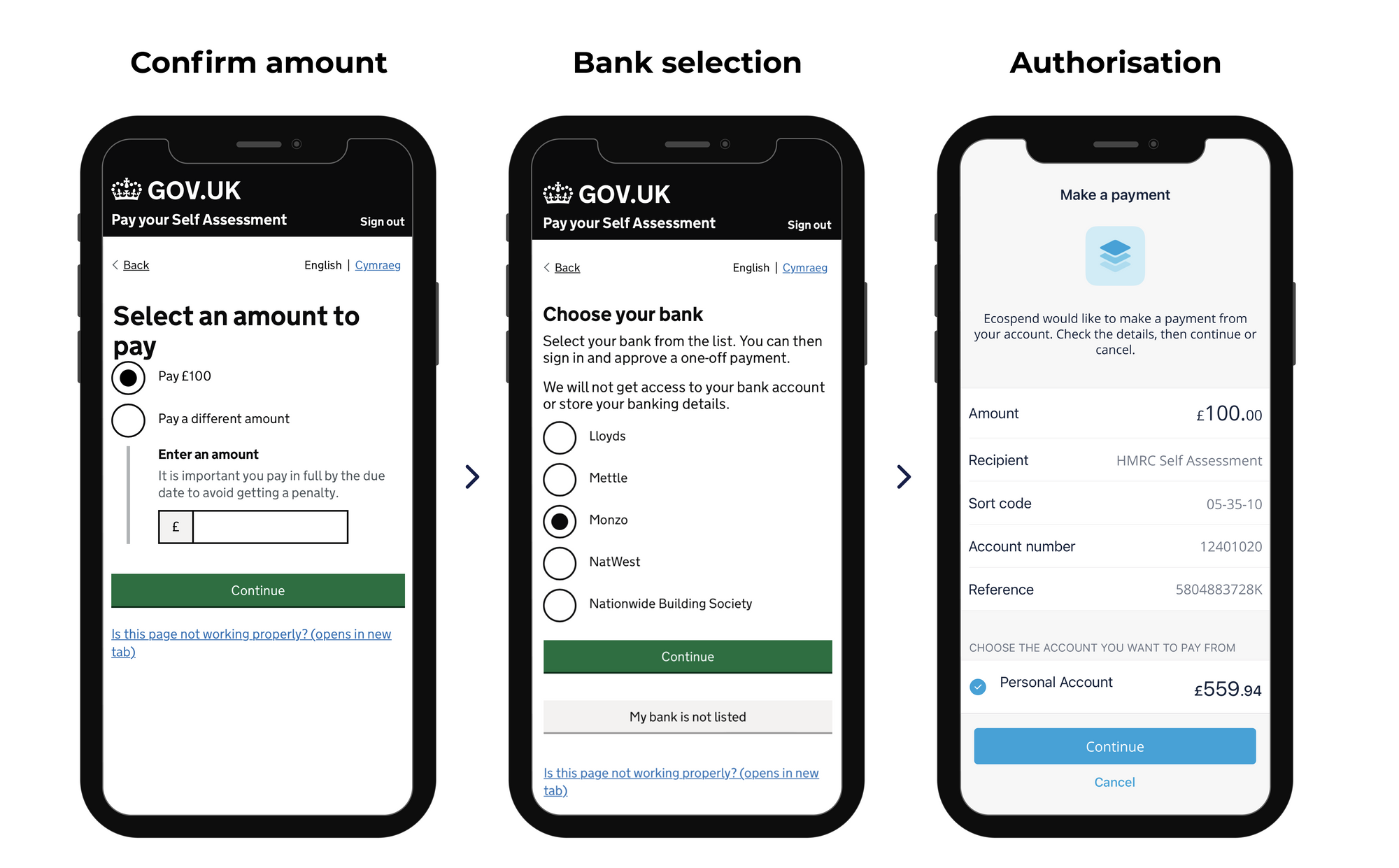

1. Paying your taxes with HMRC

Last year, HMRC made history by becoming the first ever tax authority to allow open banking payments.

We all know paying tax isn't fun, but making the process quicker and easier for millions of people can only be a good thing. Today, instead of having to set up a one-off direct debit or enter card details, taxpayers can 'Pay by bank account', quickly approving their tax payment in their mobile banking app.

After supporting over £1 billion in tax payments in its first year alone, HMRC reported great feedback from users:

“Discovering the new way to pay which links straight to my bank account was great - I'm always worried if I have the right HMRC account to pay into so this took the worry out of it.”

Key benefits

- Reduces friction during an unenjoyable but necessary process;

- Reassures taxpayers that their money is going to the right place.

A2A payments are particularly useful for minimising human error because there is minimal data entry. In the case of HMRC where there may be multiple recipient bank accounts, A2A leaves no room for confusion as the appropriate bank details are automatically pre-populated when it's time to approve the payment.

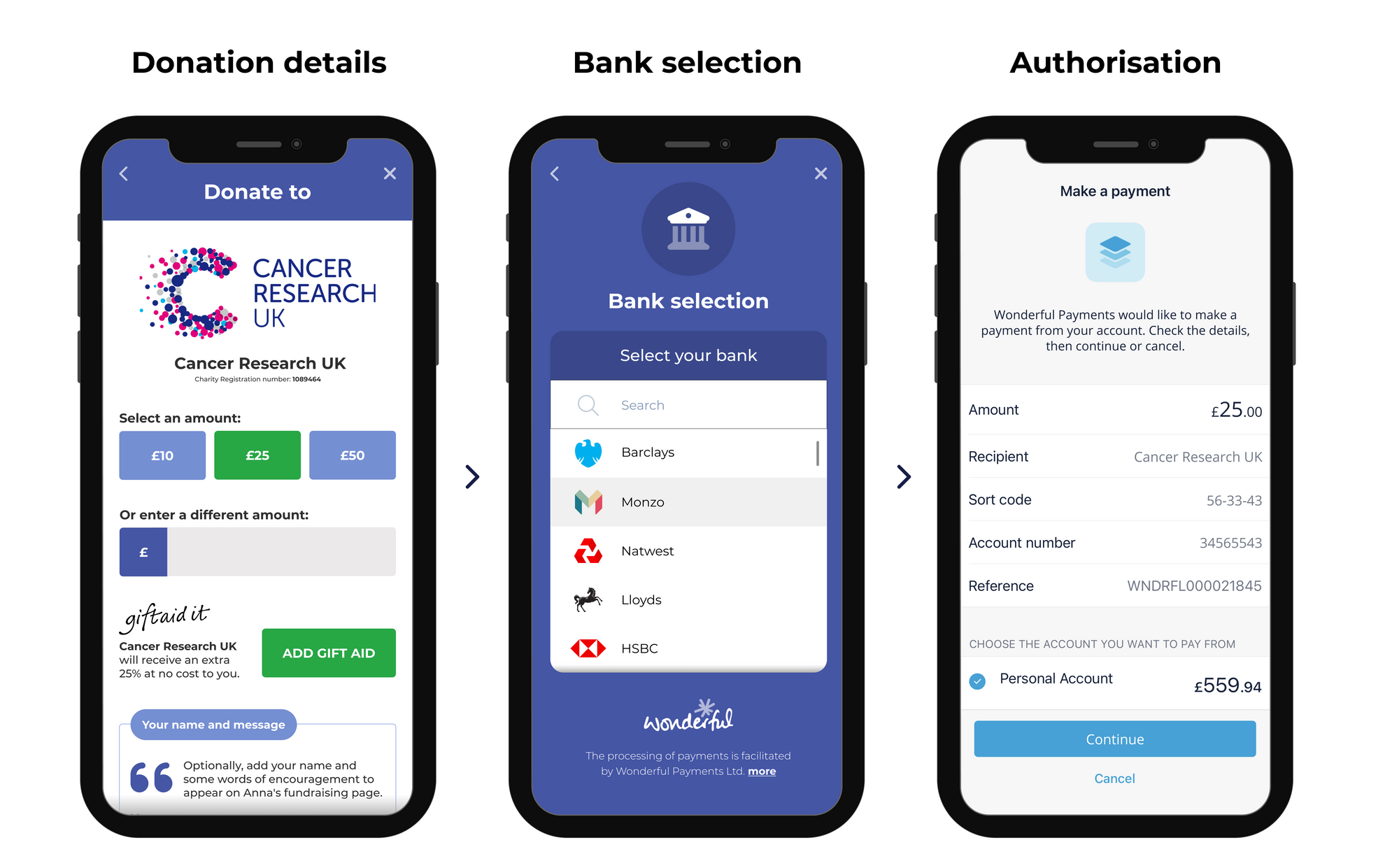

2. Donating to charity with Wonderful

As mentioned, instant bank payments offer huge opportunities to reduce costs for businesses, but this extends to charities too.

In the case of Wonderful, A2A payments allow donations to be passed directly (and in full) to registered charities, including as part of online fundraising campaigns.

Traditionally, online giving platforms have used card payments, which don't reach charities instantly and carry fees (usually paid by the charity, if not via additional contributions from donors). Instead, Wonderful harnesses the power of A2A payments to pass 100% of the donation directly and instantly to the charity, with no charges or fees.

At the same time, the user experience for the donor is a breath of fresh air.

Key benefits

- Removing fees means charities receive more, and can do more with funds raised.

- Charities can access funds instantly and respond more quickly to disasters and other emergency situations.

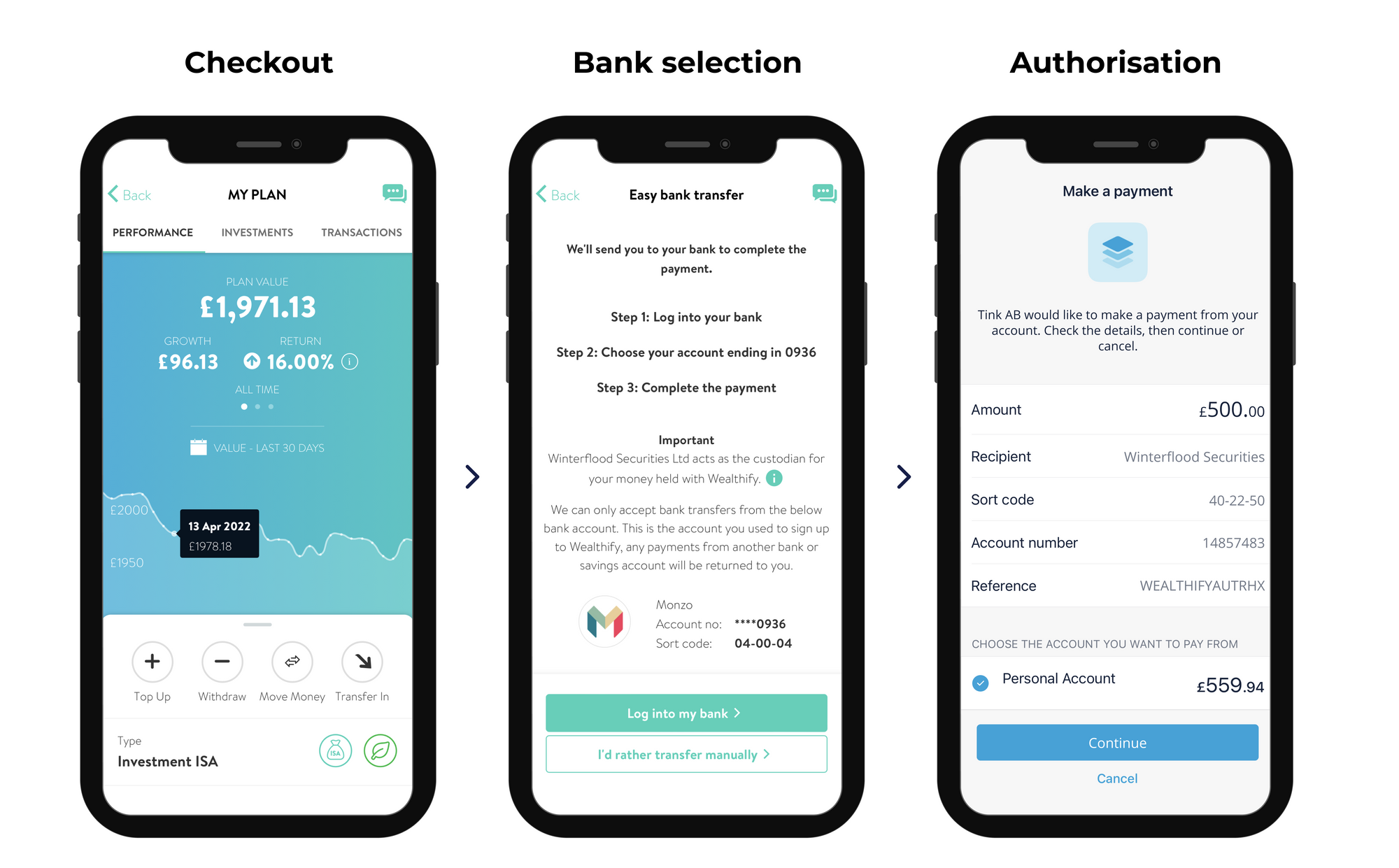

3. Topping up your ISA with Wealthify

Personal finance is an area where open banking in general is being put to great use. As various money management and investment apps come to market, it's no surprise these FinTechs are taking advantage of new and improved online payment systems.

Personal investment app, Wealthify, recently began allowing customers to quickly and easily top up their savings and investments accounts via A2A payments.

Previously, Wealthify customers had to set up a manual bank transfer, making sure to include an exact payment reference so that their money went to a specific investment plan. Now, customers can simply choose their plan, the amount they wish to top up and approve the transfer in their mobile banking app. Everything else is handled automatically in the background meaning there are no scary references, account numbers or sort codes to enter.

The whole process of topping up your account is also much faster as a result.

Key benefits

- Incredibly user-friendly and secure top-up experience, boosting customer convenience and satisfaction.

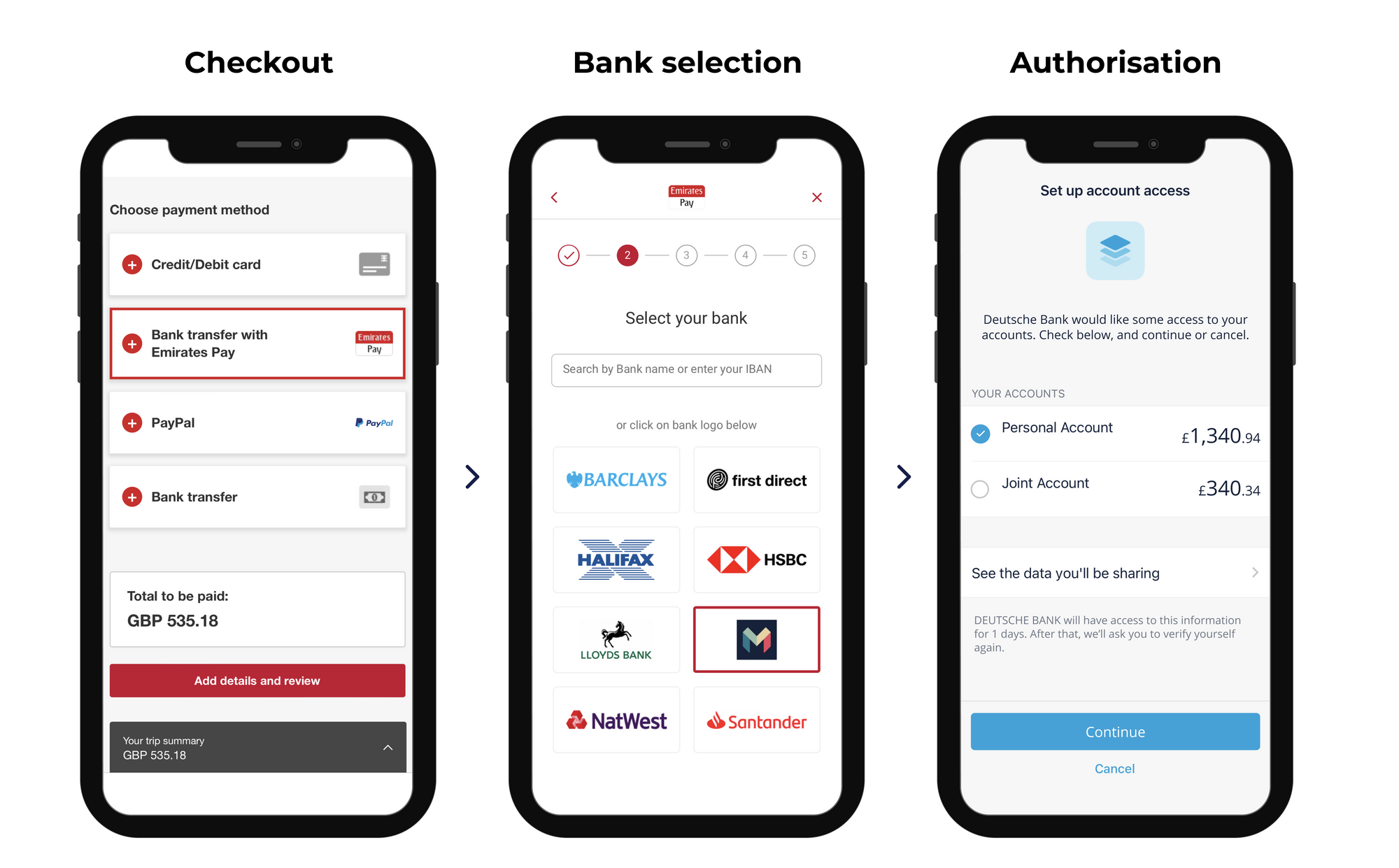

4. Purchasing flights with Emirates

Flights can be very expensive, especially when booking that special holiday of a lifetime.

When it's time to pay, we're all familiar with the process of digging out a card and entering various payment details - only to be told one of the numbers isn't correct or the billing address is wrong. It's a far cry from lying by the pool, cocktail in hand.

A few airlines, including Emirates, have begun to improve the checkout process for their customers with instant bank payments. This streamlines what can sometimes be a stressful experience, with customers having spent enough time and energy shopping around for the best deal.

For large airlines like Emirates, the savings that can be made on transaction fees are significant, especially when we consider the cost of long-haul flights. Generally, when we pay by card, the transaction fee is a percentage of transaction value.

Emirates still offers other payment processing solutions, but the recent addition of 'Bank transfer with Emirates Pay' is a great example of A2A payments in action.

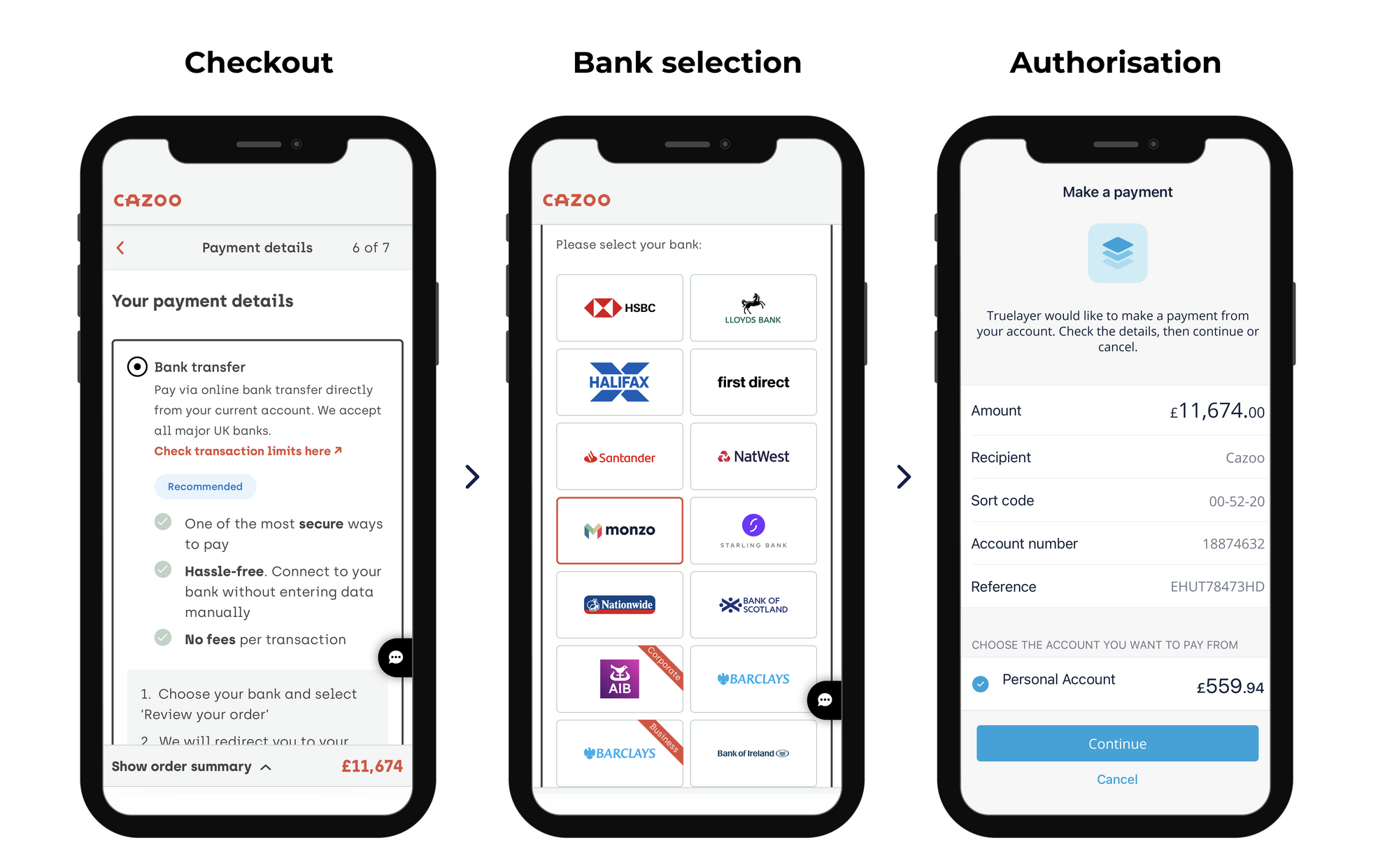

5. Buying a car with Cazoo

Cazoo is disrupting the market with their online car purchase and delivery service. This car dealer offers maximum convenience to its customers, which extends to the payment experience.

Cazoo reassures its customers that their easy bank transfers are one of the most secure ways to pay, without entering data manually.

What can we expect going forwards?

In the next few years we can expect to see instant payments become a very common sight at the checkout as more brands and service providers realise the benefits. This is great news for everyone, as account-to-account payments improve the customer experience as well as reducing transaction fees for small business payments.

There are some challenges to overcome, including boosting consumer awareness about how these payments work. It doesn't help that different providers seem to have different names for the same payment method, be it 'A2A' (account-to-account), 'Bank transfer' (which may wrongly imply the process is manual), 'Pay by bank' or something else. In line with the concept of open banking itself, the Fintech industry must look towards standardisation to improve consumer awareness and confidence. This extends to banks, who must continue to work together to provide standardised technical systems for initiating the payments.