How can online businesses reduce payment processing fees?

![]() Carmen James

-

Carmen James

-

UK merchants can strategically manage payment processing fees, potentially saving thousands of pounds each year. Here's how...

In their latest Payments Survey report, the British Retail Consortium demonstrated that the costs associated with processing online payments are continuing to rise. At the same time, Open Banking-powered payment processing services and alternative payment methods presents real opportunities for retailers to reduce payment processing fees.

So, how exactly can online businesses reduce payment processing fees in order to stay competitive and remain profitable?

In this article, we'll cover the main areas you'll need to focus on so that you can make the best decisions for your business, with your customers front of mind. We'll also discuss the importance of choosing the right online payment processor and how to evaluate potential solutions to your advantage.

Negotiate. Payment processing fees are rarely fixed.

Are merchant fees negotiable? Absolutely. It's quite common for businesses to negotiate payment processing fees with their payment provider. Many providers will display headline rates on their websites, but will also be open to negotiation with both prospective and existing customers. This allows for some movement based on volume and contract length. Take some time to understand the existing fee structures in the payment processing market.

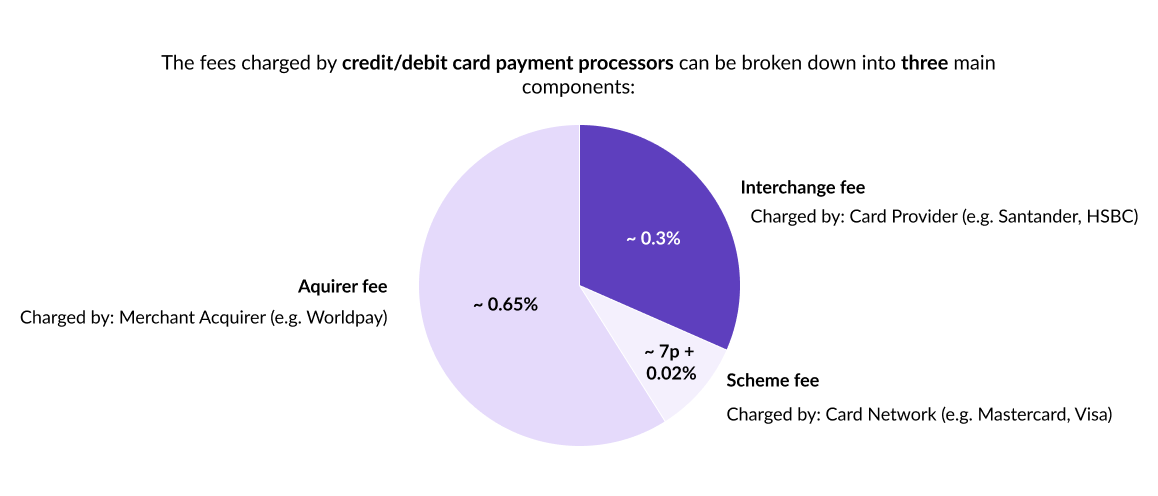

In the case of credit and debit card payments, the fee you pay your card payment provider can be broken down into three main components. You won't always be shown these individual components, but they are what determine the fee you pay to your payment provider:

- Acquirer fee (charged by the Merchant Acquirer - Barclaycard, Worldpay);

- Interchange fee (charged by the issuing Card Provider - your customer's bank);

- Scheme fee (charged by the Card Network - Visa, Mastercard).

The Merchant Acquirer, Card provider and Card Network operate in the background to tackle risks and split costs, and what results is the fee you pay your payment processor. You should have a basic understanding of this structure in order to best negotiate fees and spot outliers in discussions with your payment processor.

Example processing fee for credit/debit cards

Stripe: 1.5% + 20p (standard UK cards)

Consider alternative payment methods

In recent years, alternative online payment methods have become increasingly popular and widely accessible to customers. Consumer demand is driving a shift away from more traditional payment methods like cash, cheque and credit cards, and opening up a world of opportunity for businesses and consumers alike.

Alternative payments include quite a wide range of separate payment solutions, including open banking payments, digital wallets like PayPal, Buy Now Pay Later (BNPL) and cryptocurrencies. The costs to accept payments via these methods is equally varied, but Open Banking payments in particular (Payment Initiation Services), are among the most cost-effective payment methods available today. Many retailers are already taking advantage of Payment Initiation Services to dramatically reduce processing costs and remove friction from the checkout flow. There are a number of payment processing alternatives to stripe in the UK.

Example processing fees for alternative payment methods

BNPL: Klarna: 2.49% + 20p

Open Banking payments: Wonderful: 0% + 1p

Cryptocurrencies: Coingate: 1%

Digital wallet: PayPal: 1.2% + 30p

Based on your average transaction value and your volume of transactions, the processing fees for alternative payment providers will vary hugely. Only a sub-set of alternative payment methods result in cost savings compared to traditional card payments, but those that do have the potential to make a huge impact.

Almost all alternative online payment providers will provide a fully documented API, so that merchants can directly integrate them into their checkouts and have full control over the customer experience.

Introducing One: Instant bank payments, with purpose.

One is a simple and intuitive mobile app that allows businesses to slash transaction fees, bill for any product or service, and request instant payments via Qr codes or secure links. 1,000 transactions for just £9.99 per month (that's just 1p per transaction).

Cancel anytime.Consolidate payment methods to take advantage of volume discounts

The payment processing fee you are charged is usually dependent on your transaction volume, so in some cases, it can make sense to consolidate payment methods in order to take advantage of volume discounts. There is, of course, a balance to be struck here. A good understanding of customer payment preferences is required to ensure that you are not negatively impacting sales by restricting choice at the checkout.

Actively tackle chargebacks

Chargebacks occur when a customer disputes a credit/debit card charge and initiates a refund for their purchase directly with the issuing bank. Optimising card payment costs involves minimising chargebacks as much as reasonably possible.

Chargebacks can be significantly reduced or eliminated completely by taking advantage of some of the alternative payment methods mentioned above. For example, open banking payments, which involve a direct pre-populated bank transfer, with inherent Strong Customer Authentication, simply cannot be subject to chargebacks.

However, when it comes to credit and debit card payments, there are still a number of ways merchants can bring down the number of chargebacks and reduce overall costs.

Key methods for tackling chargebacks

- Always providing transparent pricing, clearly stating the price and final costs to the customer before they authorise a payment;

- Avoid using a trading name that might not be recognised by customers when viewing bank statements;

- Clearly communicating return and dispute policies;

- In the event of a chargeback occurring, merchants may be able to provide supporting evidence to the payment provider/issuing bank to prove the dispute is invalid. This process usually has strict deadlines, and should only be used when there is clear evidence of a deliberate, illegitimate chargeback or 'friendly fraud'.

Read more

UK retailers spent £1.2 billion processing card payments in 2021: British Retail Consortium Payments Survey

Introducing One: Instant bank payments, with purpose.

One is a simple and intuitive mobile app that allows businesses to slash transaction fees, bill for any product or service, and request instant payments via Qr codes or secure links. 1,000 transactions for just £9.99 per month (that's just 1p per transaction).

Cancel anytime.