How businesses can speed up payment processing with real-time payments

Kingsley Ohia

-

Looking to ensure customer payments reach your account as quickly as possible? Modern payment systems are really speeding things up...

In today's ever-connected world, it's easy to assume all payments are processed instantly, but processing times can vary greatly and this can have a direct impact on cash flow. So how can businesses minimise payment processing times and access their hard-earned funds as quickly as possible?

How long does payment processing usually take?

In reality, no payment is truly instantaneous, so how long does it take for a merchant to receive funds? Typically, payments can take anywhere between a couple of seconds to a number of business days. This depends mainly on the choice of payment method...

Cheques

2 business days

Although not widely used today, cheques can be a useful payment method in specific situations. The majority of UK banks now employ cheque imaging technology, which expedites cheque clearance—ensuring completion by 23:59 on the following weekday (excluding bank holidays), or in many instances, earlier (provided that the cheque has not bounced).

Debit cards

1-3 business days

Because card payments introduce a third-party payment provider, and a card network into the mix, processing can take up to three days. This may sometimes be longer, for example, if the payment was made from abroad, or due to other automated security checks at the customer's bank.

Credit cards

1-3 business days

Credit card processors often group large batches of pre-authorised business payments before processing them at regular intervals, so funds are not instantly available to merchants, even if they appear to have left the customer's account.

Instant bank payments

1-2 seconds (sometimes a few minutes)

Many merchants now take advantage of instant payments by integrating with an Open Banking payment provider. One of the many benefits of this modern, efficient and secure payment method is the speed with which funds are settled. These payments are like direct bank transfers, but the amount and recipient (merchant) bank account are pre-populated, ready for the customer to authorise in the mobile / online banking interface they know and trust. There's no data entry required by the customer, so the payment experience itself is slick and friction-free.

Unlike card payments, instant bank payments can be fully processed and settled at any time of day, including on weekends and holidays.

Do 'real-time' payment solutions exist in the UK?

While no payment can be truly instantaneous, in effect, we can get incredibly close!

"Real-time payments" as an offering are growing rapidly across the world as payments infrastructure becomes more powerful and integrated. The UK has its own instant payment scheme known as Faster Payments, and the instant bank payments described above make use of this real-time pay online system. Merchants can integrate with authorised bank payment providers (also known as PISPs), and in fact, the innovations made by these payment gateways often mean a reduction in transaction fees.

Recently, the Faster Payments system announced plans to further upgrade its architecture to meet higher security standards and improve ease of integration.

How can I speed up my payment processing?

Make use of instant payment methods

As mentioned, traditional payment methods such as credit / debit cards and cheques can take longer to process. But thanks to Open Banking and the Faster Payments system, businesses can accept payments by integrating with a real-time payment processor and get paid instantly

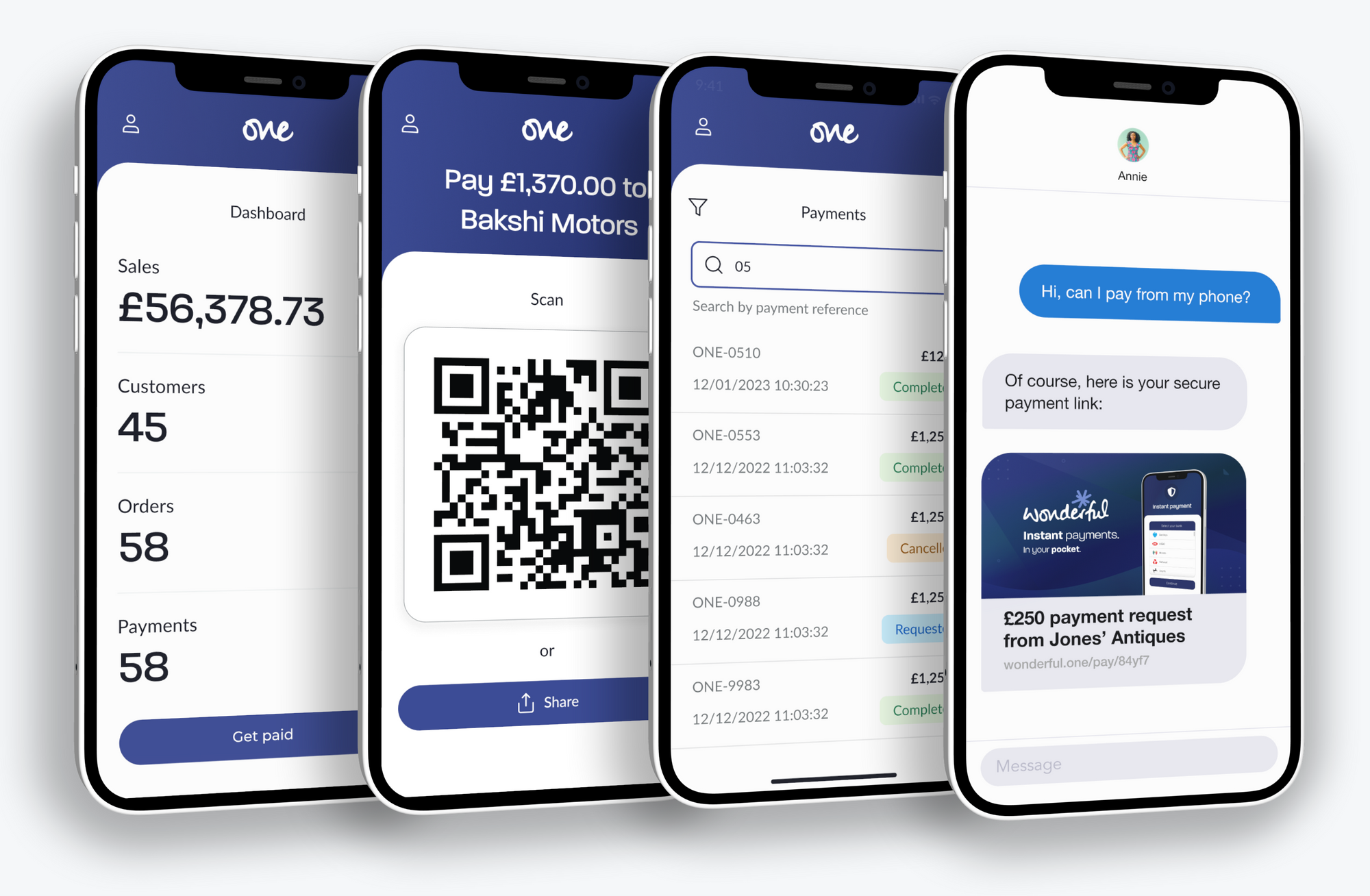

So, which online payment gateways give instant settlement? Thankfully, UK retailers can already make use of a range of payment initiation service providers, including via simple mobile POS apps, where merchants can set up and request instant payments from customers via QR pay or secure payment links.

Need card payments? Look at same-day / instant payout services

If you want to accept card payments so that your customers have as much choice as possible, you'll need to accept that funds will pass through multiple intermediaries before they reach your merchant account. However, most popular card payment providers offer same-day or next-day payouts for an additional cost. This charge is typically 1-2% per transaction, and bear in mind that 'same day' does not mean instant.

As an example, Stripe's instant payouts feature ensures funds are in your merchant account within 30 minutes and charges a 1% fee for the service. Of course, 30 minutes is far longer than the few seconds it often takes to process an instant bank payment, so consider promoting an instant bank payment at the checkout or on invoices if you really want to give cash flow a boost. Here are some viable stripe alternatives you can consider.

More tips to speed up payment processing

As well as choosing and promoting the right payment methods, there are a number of more general ways you can minimise payment processing times and improve cash flow:

- Automate your invoicing, including reminders.

- Provide incentives for upfront or early payments.

- Actively tackle chargebacks.

- Consider late payment fees if appropriate.

- Use an integrated, multi-channel Point of Sale system.

Wonderful provides instant pay by bank payments to UK businesses, helping them slash transaction fees, improve security, and remove friction from the checkout experience. What's more, payment processing companies like Wonderful don't necessarily have to replace your existing payment methods. Get started by sending simple, secure payment requests using the One mobile app...

Introducing One: Instant bank payments, with purpose.

One is a simple and intuitive mobile app that allows businesses to slash transaction fees, bill for any product or service, and request instant payments via QR codes or secure links. 1,000 transactions for just £9.99 per month (that's just 1p per transaction).