Open banking for dummies: Everything you need to know

![]() Carmen James

-

Carmen James

-

Feeling confused about what open banking is? Let us explain it in layman's terms so you can be clued up, impress your friends, and more importantly, make better financial decisions.

What is open banking?

In layman's terms...

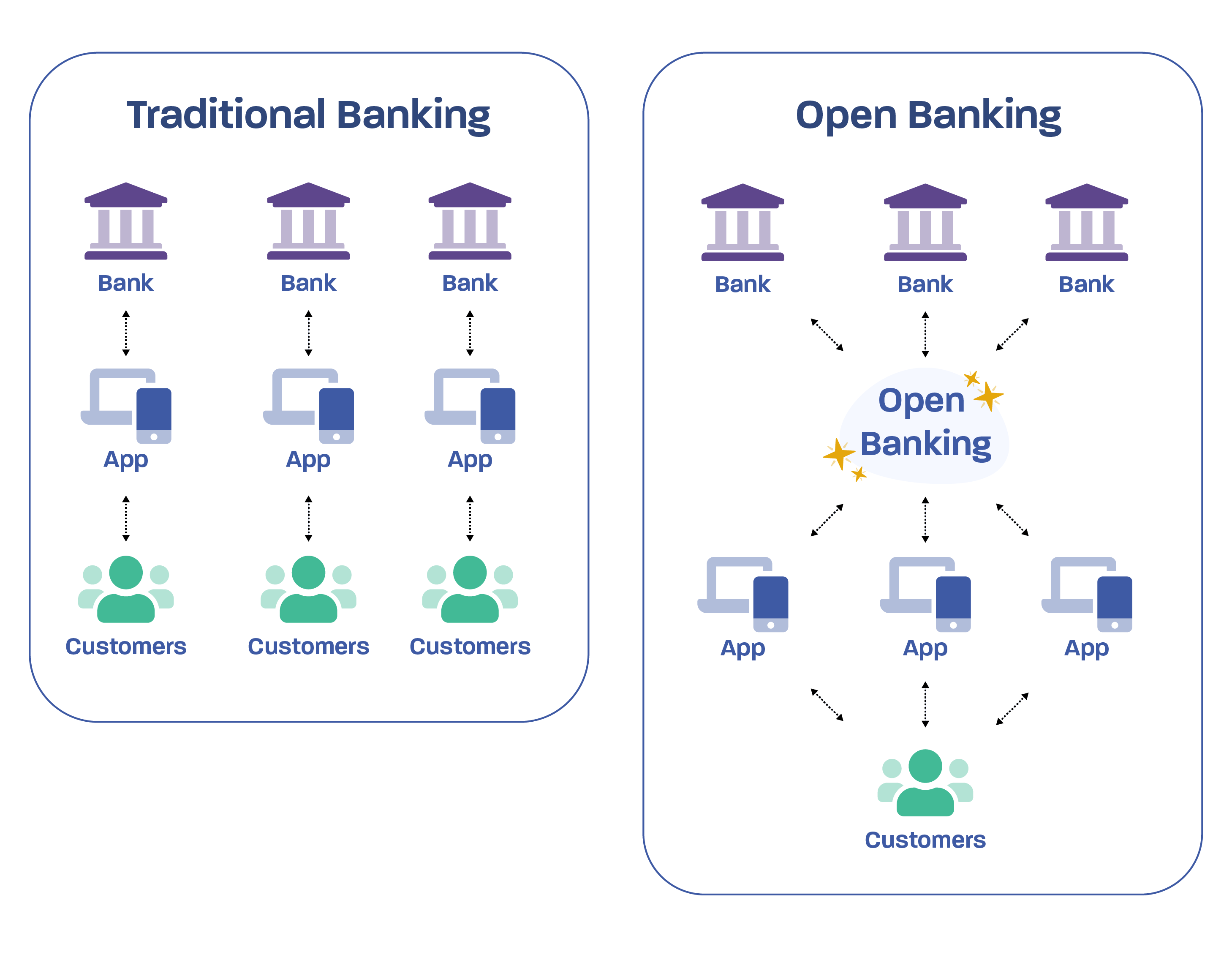

open banking is a new standard that allows ordinary people to grant permission for their financial information to be securely shared between banks and other financial service providers.

By providing a secure framework for the exchange of financial data, new products can be built for consumers and businesses that solve everyday problems or bring added value to our lives.

If that hasn't blown your socks off with excitement don't worry, open banking is a bit like the internet: its definition isn't hugely exciting, but the things people build with it can be truly wonderful!

How is open banking different?

Before open banking, much of our financial information was isolated. The big banks and other financial services decided for themselves whether your data could be shared and how it could be done. Skip to 2018, and the Competition and Markets Authority forced the UK's 9 biggest banks, to securely open up your transaction data to other organisations and third-party services, only at your request and with your explicit consent.

In today’s world, each and every one of us has a footprint of financial data that’s driven by the actions we take. Every coffee purchased, every bank transfer made and every bill we pay contributes to our unique financial record. Before open banking, it was difficult for consumers and service providers to make use of all this information because there was no standardised and secure way of sharing it. This also meant information could be shared in less secure ways, such as by emailing a bank statement. Unfortunately, email is not a secure method for sharing financial data!

It's important to note: open banking doesn't mean our financial information is out on display for any provider to access! Open banking, by design, means that sharing your bank balance, transaction data or even making payments can only happen with your specific consent, and only to/from organisations strictly regulated by the Financial Conduct Authority.

Why we need open banking

It's all about the competition

You might be wondering who came up with open banking and what the motivation was to introduce it across the country. Open banking is the UK's response to PSD2 - a new set of regulations that have been introduced to make online payment services safer, increase consumers' financial protection, foster competition and innovation, while creating a level playing field for financial service providers, including budding startups.

So what's so great about all this? Well, open banking is fuelling a revolution in new financial products that solve real problems for consumers and businesses. Let's put this in context with some real-world examples...

5 fantastic examples of open banking in action

Yolt

A birds-eye view of every bank account, credit card, investment fund and pension pot you own.

Yolt is a money management app for smartphones that allows you to see a birds-eye view of your entire financial life. Every current account, savings account, credit card, investment fund and pension pot you own can be added to your personal dashboard via open banking. You'll see beautifully simple graphs of your saving and spending activity, and like some of the more 'intelligent' banking apps available today you get budgeting tools and automatic categorisation of your transactions (travel, groceries, bills, entertainment). Because of the beauty of open banking, you can move money between accounts too. Yolt's free service contains everything mentioned about at not cost, and you'll get a free Mastercard designed for your daily spending (but it's entirely optional). Before open banking this level of money management simply wouldn't have been possible.

Wonderful

Instant bank payments at just 1p per transaction.

Wonderful offers an online payment service that has harnessed the speed, simplicity and security of Open Banking payments - introducing an excellent deal to UK businesses and the third sector (the service is completely free for UK registered charities). There's no digging around for credit card details or getting frustrated because you're sure you've entered your CVV code correctly. Instead, Wonderful has replaced card-processing with Open Banking which securely connects the merchant's customer (or charity supporter) to their mobile banking app or online bank account to swiftly authorise a payment.

Credit ladder

Improving your credit score by automatically detecting and verifying when you've paid your rent.

Credit agencies like Experian and Equifax are used by countless providers to determine your credit score. Everyone's credit score if uniquely determined by their own spending habits and is used to approve or deny access to things like credit cards, mortgages and car loans. Historically, hard working people who pay their rent on time have not been able to use their rent payments to boost their credit score. But now, Credit Ladder is using open banking to quickly and securely access your bank statements and automatically verify each time you pay your rent. This information is reported back to Experian, Equifax or both, in order to improve your credit score without you having to lift a finger. The service is completely free for tenants if you report to one credit agency, with a subscription billing option allowing you to report to both.

CoGo

Automatically estimate your carbon footprint and measure your social impact based on all of the payments you make.

You transaction history, as well as revealing a lot about your behaviour and lifestyle choices, can also be a very good indicator of your social and environmental impact. CoGo is a new personal finance app developed with climate experts and data scientists to intelligently analyse your carbon footprint and other impacts based on your spending habits. CoGo uses open banking to connect to your bank account(s) and automatically categorise purchases based on different factors like CO2 emissions. You'll quickly see the relative effects of different purchases like plane tickets, car petrol and supermarket/grocery shops. You can also delve into factors like charitable giving, buying new vs. used, supporting London Living Wage businesses, social enterprises and more.

Sustainably

Connect your bank account and round up your daily spend so that your spare change goes to good causes.

Sustainably uses open banking to securely connect to your existing bank account, allowing you to round up your daily spending to the nearest pound and automatically donate that amount to good causes. The mobile app also offers flexible monthly donations so you can 'set and forget' or chop and change where your money goes each month. You'll get regular updates from the causes you support so you can see exactly how your donations are making a difference. Sustainably uses card transactions rather than open banking for payments initiation, and the charities cover the transaction fees of 1.2% + 10p.

Which UK banks are compatible with Open Banking?

When Open Banking was first introduced, the UK's 9 biggest high street banks and building societies had to offer Open Banking to their customers straight away. Since then, many other banks have made the service available.

Here's the full list according to Open Banking:

- Allied Irish Bank

- Arbuthnot Latham & Co Limited

- Bank of Ireland UK

- Bank of Scotland

- Barclays

- BFC Bank

- C Hoare & Co

- Clydesdale Bank

- Contis

- Coutts & Company

- Coventry Building Society

- Creation Financial Services

- Cynergy Bank

- Danske

- Ghana International Bank

- Halifax

- Hargreaves Lansdown Savings

- HSBC

- ICBC (London)

- Industrial and Commercial Bank of China

- Investec

- Lloyds Bank

- M&S

- MBNA

- Metro Bank

- Mizuho Bank

- Nationwide

- NatWest

- NewDay

- Permanent TSB

- Prepay Technologies

- Project Imagine

- Revolut

- Sainsbury’s Bank

- Santander

- SG Kleinwort Hambros Bank

- Starling Bank

- Tesco Bank

- The Co-operative Bank

- The Governor and Company of the Bank of Ireland

- The Royal Bank of Scotland

- The Royal Bank of Scotland International

- Tide Platform

- TSB Bank

- Turkiye Is Bankasi As

- Ulster Bank

- Ulster Bank Ireland DAC

- Union Bank of India

- Vanquis Bank

- Virgin Money

- Wirepayer

- Yorkshire Building Society

Is Open Banking safe?

Learn about Open Banking security

The good thing about open banking is that it uses the existing security of the your own bank account (built and managed by your bank). As with any new technology, that doesn't mean scammers won't try to exploit it, so you should still remain vigilant when it comes to granting access to third parties. Naturally, you should never share your online banking password or log in info with anyone except your own bank. When connecting accounts or online payment processing via open banking, the authorisation should happen via your existing online banking interface or mobile banking app.

Consent

At the heart of the open banking ecosystem are robust standards for obtaining consent from consumers when it comes to accessing their financial data. Services using open banking to access your data must be clear about how long your consent lasts, and provide you with simple tools to manage this consent, including revoking it at any time.

What happens to my data?

All providers have to follow the same data protection rules including the GDPR. Providers can’t access your data willy-nilly. Instead, they must tell you which data they are going to access and it must be a part of the service they’re providing.

How do I know if a company is safe?

Companies providing open banking services must be registered with the Financial Conduct Authority (FCA) - the body responsible for regulating UK financial services firms. The FCA Register is a searchable list of all regulated companies. There is also the Open Banking Directory, which lists all the regulated providers using open banking technology. When using a new service that is asking to gain access to your financial accounts or data you should check that they are a regulated provider.

If a company you're using isn't listed as a regulated provider they be be using a third party service that is authorised and listed. If this is the case the provider will be able to confirm this with you directly.

What to do when something isn't right

If you have any concerns about a provider asking to connect to one of your accounts you should ask them to clarify their data security policies, including who they are regulated by. If something doesn't seem right take a step back and get help. You can seek advice from your own bank and you can contact the Financial Ombudsman Service if you need to file a formal complaint.

If you're concerned about how a company has handled your personal information including our financial data, you may wish to contact the ICO.

Resources

Open Banking Directory (A list of regulated UK open banking providers.)

Financial Services Register (A list of all financial service providers regulated by the Financial Conduct Authority.)

Wonderful Supported Banks (A list of all banks supported by Wonderful for instant bank payments - both for sending and receiving payments.)

Wonderful Open Banking Savings Calculator (an interactive cost-comparison tool to calculate savings for merchants of instant bank payments vs card payments and PayPal.)