What to look for in POS systems: integration

Kingsley Ohia

-

Swish new POS systems are tempting, but don't underestimate the importance of seamless integration.

Today, our series on finding the best Point of Sale system for your business draws to a close, and we’re shifting focus to the bigger picture: how your POS system fits in with your existing processes.

If you’re keen to ensure you have the ideal Point of Sale system, make sure you catch up on the rest of our series. So far, we’ve covered:

- Multi-channel online payment solutions

- Simplicity

- Cost

- Instant payments

- Security

- ESG

And today we move onto a final and crucial factor: integration.

Just as excessive bells, whistles and physical devices can end up being counterproductive, the most cutting-edge, hi-tech POS solution becomes a headache if it makes you throw out your existing payment and administration systems.

Your Point of Sale solution should be an addition not a replacement

As well as streamlining the payment process by reducing hardware, it’s a good idea to reduce the amount of new software and internal processes being added to the mix when you choose your POS system.

For minimal disruption and training, try adding to rather than overhauling your existing system. While it’s important to stay on top of trends, adopt new technology and meet consumers’ growing expectations, you definitely don’t need to throw everything else away in the process.

Look for frictionless integration

To make the process easiest for you and your staff, look for a provider like Wonderful that seamlessly integrates with your website and physical checkout processes. Ideally, you want a modern and simple mobile POS that can sit alongside the payment methods you already offer. That way, you let customers choose the way they pay.

You may also want a retail POS system that works with your accounting and inventory programmes.

Be aware that some providers encourage or even require you to do away with your current processes and replace them with their internal software and/or hardware. The problem is, that can be at best inconvenient, and at worst lead to failures, lost data or compromised security.

Find a system that flows smoothly into the way you work already to avoid disruptions!

Open Banking payments

Open Banking provides a great solution, because it can sit alongside your existing payment methods.

You might already allow customers to pay with cash, chip and PIN, contactless or a digital wallet in person. And online checkouts often have credit cards, debit cards, installment plans and digital wallets like PayPal or Apple Pay. An Open Banking provider like Wonderful would simply be another – easier and quicker – option both in person and online.

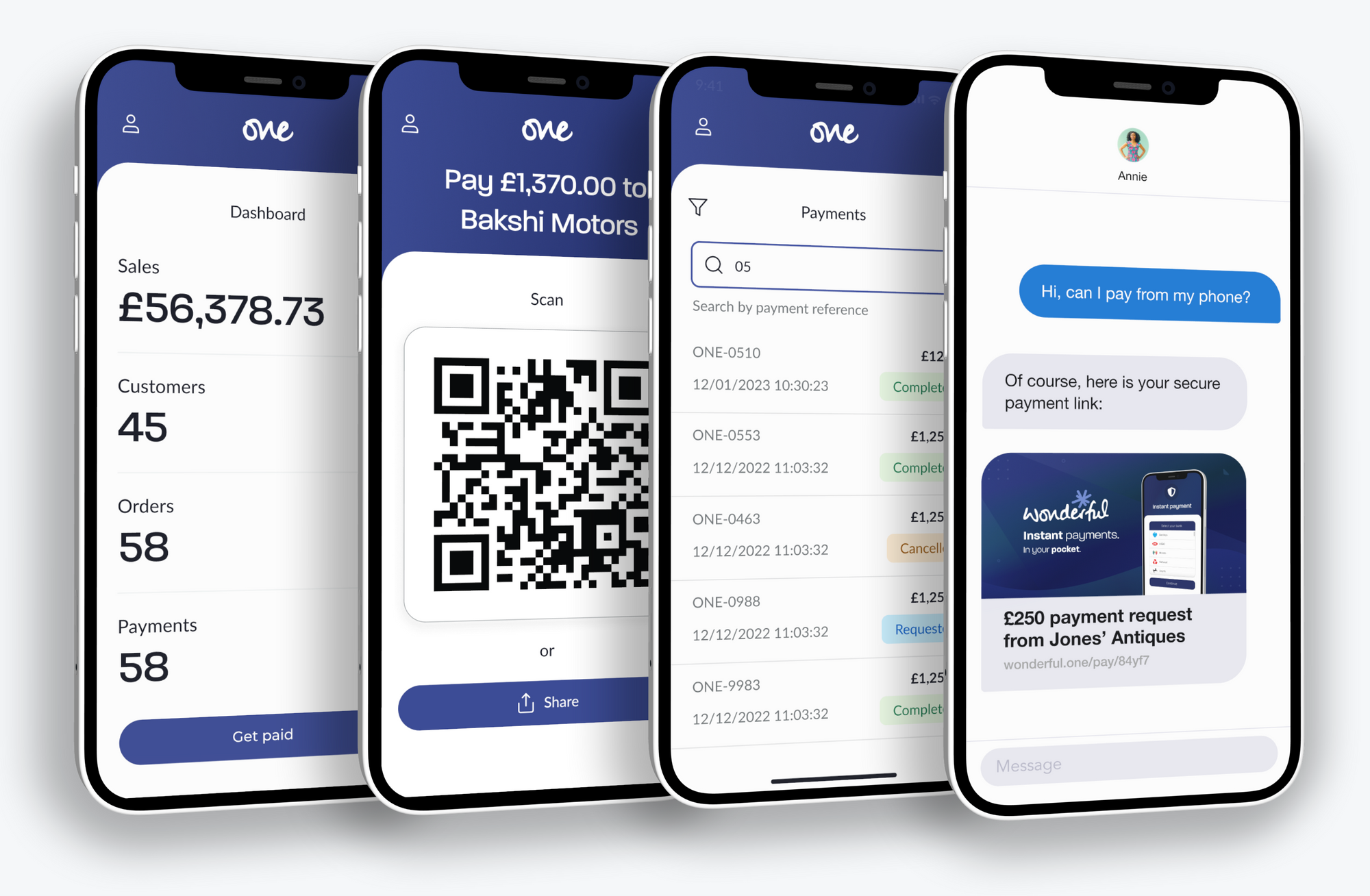

Customers only need to scan the QR code payment or click the payment link, and they’ll be taken to a pre-filled payment in their own banking app. From there, they can approve the payment in seconds using face or fingerprint ID (or whatever method they prefer), and it’s done! The money moves immediately from their bank account to yours. No need to enter a PIN or wave a phone desperately around a card reader. No waiting days (or weeks!) for the funds to reach your business’s bank account. It’s simple and instantaneous.

And because the payment goes from one bank account to the other, there’s no new technology or devices to add to the mix. Customers can pay from their smartphones, tablets or computers.

When it comes to managing your account, you can use our free and intuitive One app – again, from your own smartphone. And while we offer plenty of insights and data, you can carry on using your own systems for administration, inventory and accounting!

Introducing One: Instant bank payments, with purpose.

One is a simple and intuitive mobile app that allows businesses to slash transaction fees, bill for any product or service, and request instant payments via QR codes or secure links. 1,000 transactions for just £9.99 per month (just 1p per transaction).

Cancel anytime.Embrace the future of Point of Sale systems

To future-proof your business without overhauling it, provide Open Banking instant pay by bank payments at the point of sale.

You’ll get the newest and safest payments technology sitting alongside your current processes, while also enjoying a whole host of benefits like:

- Increased satisfaction for staff and customers

- A streamlined checkout process

- Boosting sales

- Reducing costs

- Instant payments

- Heightened security

- Inherent CSR

Plus, our friendly team is on-hand to support you through the simple onboarding and integration process, so that you can have instant payments sitting alongside your existing methods in no time. Register today! Cancel anytime.