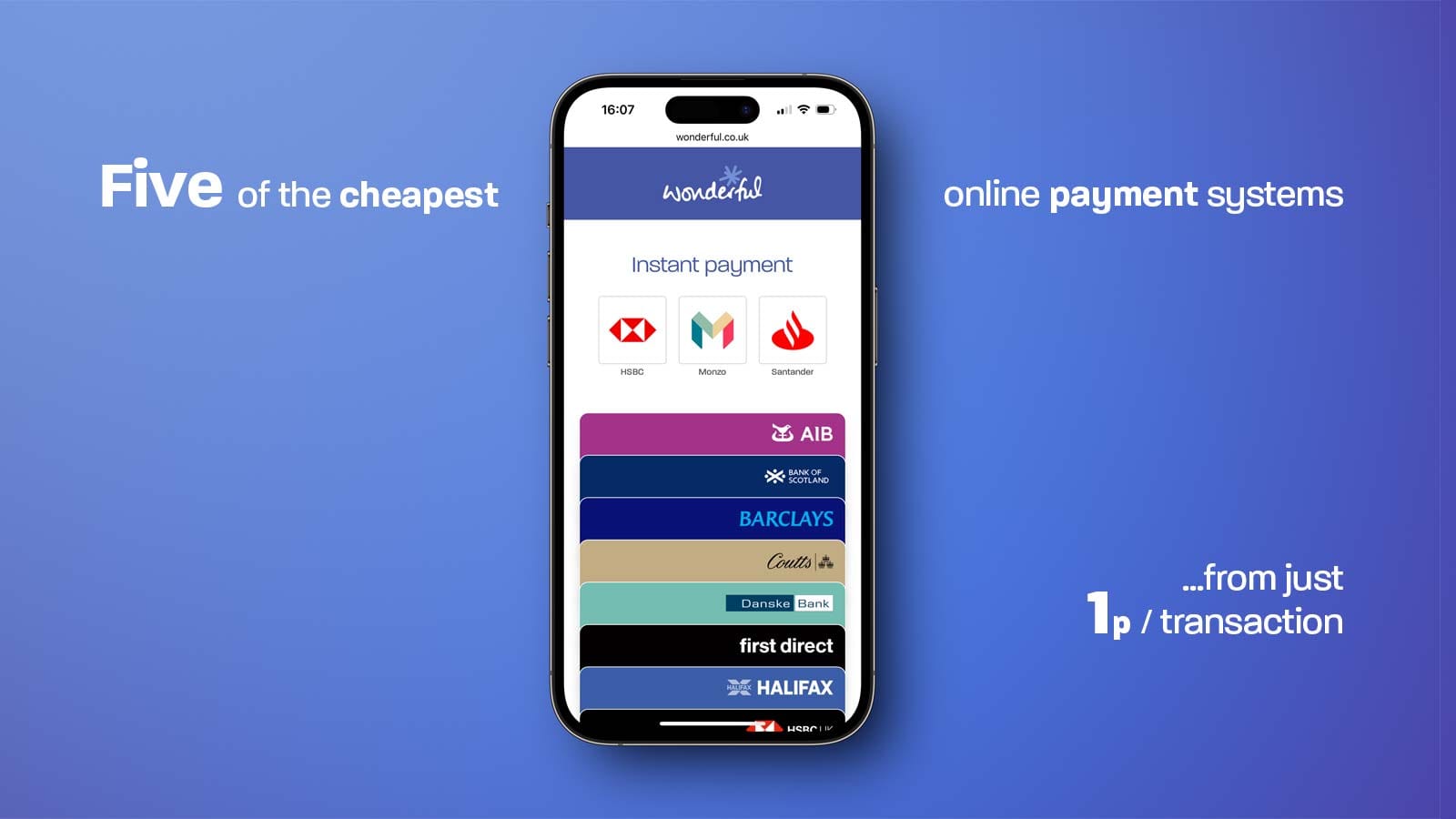

Pay by Bank: why it’s gaining ground with consumers and businesses alike

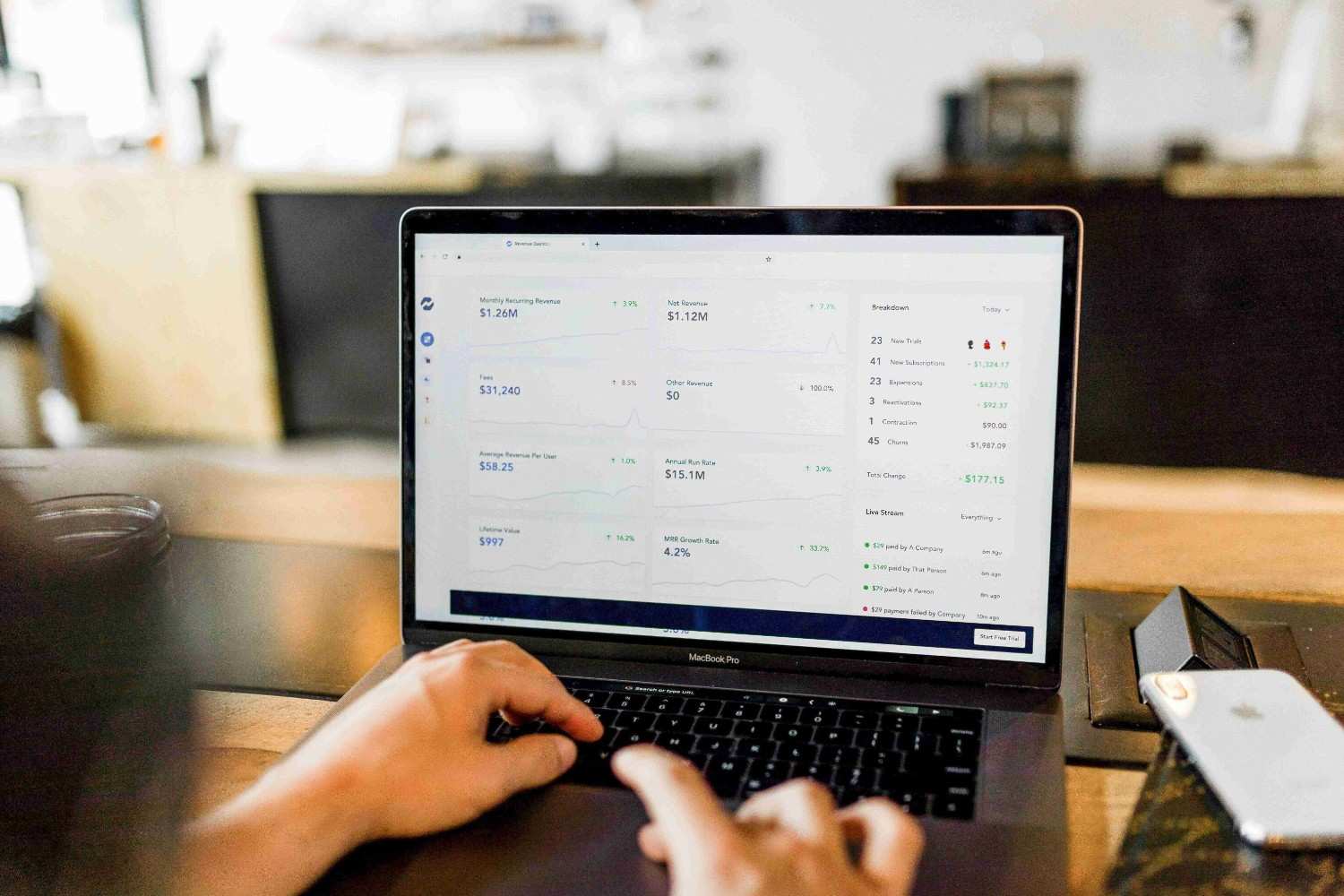

As seen on BBC Morning Live, Pay by Bank is quickly becoming a trusted alternative to cards. With lower fees, stronger security, and growing adoption, UK businesses are embracing it as a smarter way to get paid online, in-app, and with less friction.